Summary

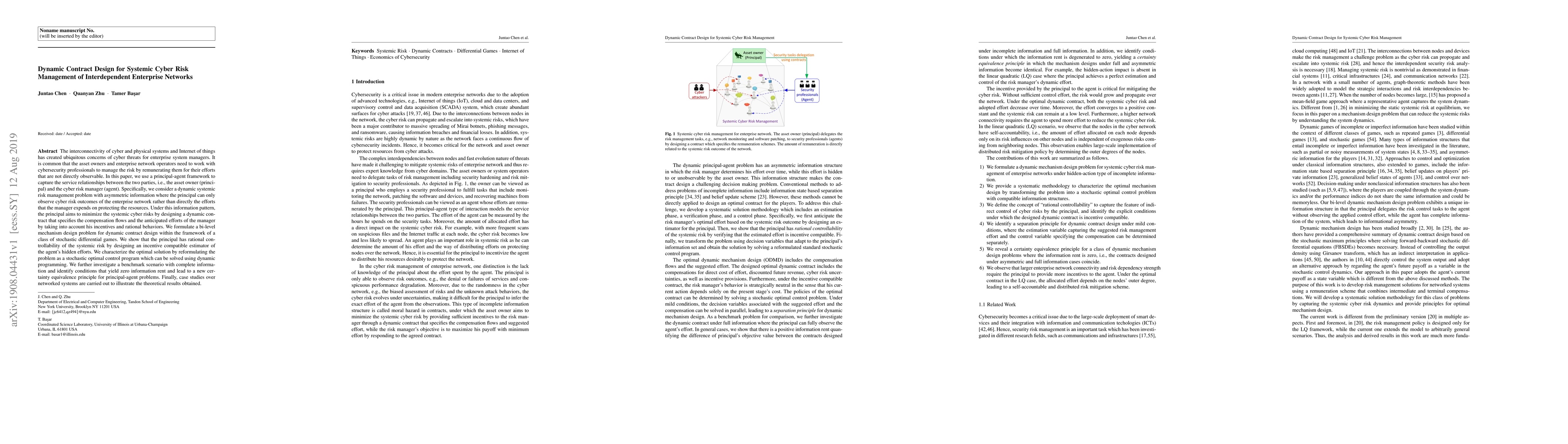

The interconnectivity of cyber and physical systems and Internet of things has created ubiquitous concerns of cyber threats for enterprise system managers. It is common that the asset owners and enterprise network operators need to work with cybersecurity professionals to manage the risk by remunerating them for their efforts that are not directly observable. In this paper, we use a principal-agent framework to capture the service relationships between the two parties, i.e., the asset owner (principal) and the cyber risk manager (agent). Specifically, we consider a dynamic systemic risk management problem with asymmetric information where the principal can only observe cyber risk outcomes of the enterprise network rather than directly the efforts that the manager expends on protecting the resources. Under this information pattern, the principal aims to minimize the systemic cyber risks by designing a dynamic contract that specifies the compensation flows and the anticipated efforts of the manager by taking into account his incentives and rational behaviors. We formulate a bi-level mechanism design problem for dynamic contract design within the framework of a class of stochastic differential games. We show that the principal has rational controllability of the systemic risk by designing an incentive compatible estimator of the agent's hidden efforts. We characterize the optimal solution by reformulating the problem as a stochastic optimal control program which can be solved using dynamic programming. We further investigate a benchmark scenario with complete information and identify conditions that yield zero information rent and lead to a new certainty equivalence principle for principal-agent problems. Finally, case studies over networked systems are carried out to illustrate the theoretical results obtained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpretable Cyber Threat Detection for Enterprise Industrial Networks: A Computational Design Science Approach

Prabhat Kumar, A. K. M. Najmul Islam

Cyber Risk Assessment for Capital Management

Linfeng Zhang, Hins Hu, Runhuan Feng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)