Authors

Summary

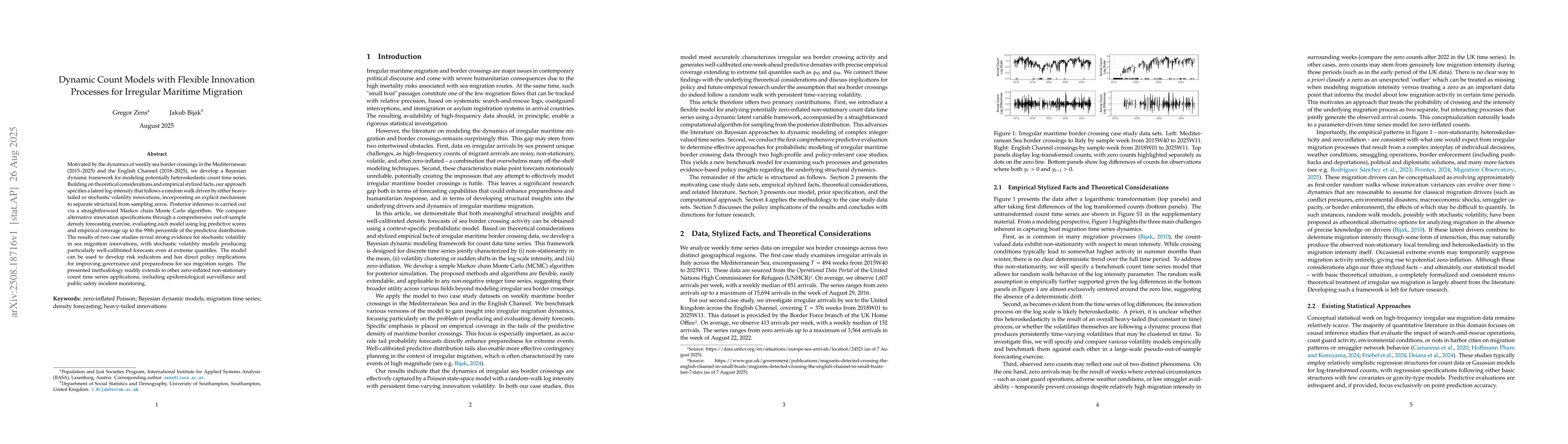

Motivated by the dynamics of weekly sea border crossings in the Mediterranean (2015-2025) and the English Channel (2018-2025), we develop a Bayesian dynamic framework for modeling potentially heteroskedastic count time series. Building on theoretical considerations and empirical stylized facts, our approach specifies a latent log-intensity that follows a random walk driven by either heavy-tailed or stochastic volatility innovations, incorporating an explicit mechanism to separate structural from sampling zeros. Posterior inference is carried out via a straightforward Markov chain Monte Carlo algorithm. We compare alternative innovation specifications through a comprehensive out-of-sample density forecasting exercise, evaluating each model using log predictive scores and empirical coverage up to the 99th percentile of the predictive distribution. The results of two case studies reveal strong evidence for stochastic volatility in sea migration innovations, with stochastic volatility models producing particularly well-calibrated forecasts even at extreme quantiles. The model can be used to develop risk indicators and has direct policy implications for improving governance and preparedness for sea migration surges. The presented methodology readily extends to other zero-inflated non-stationary count time series applications, including epidemiological surveillance and public safety incident monitoring.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDynamic Obstacle Avoidance of Unmanned Surface Vehicles in Maritime Environments Using Gaussian Processes Based Motion Planning

Danail Stoyanov, Yuanchang Liu, Jiawei Meng

Comments (0)