Summary

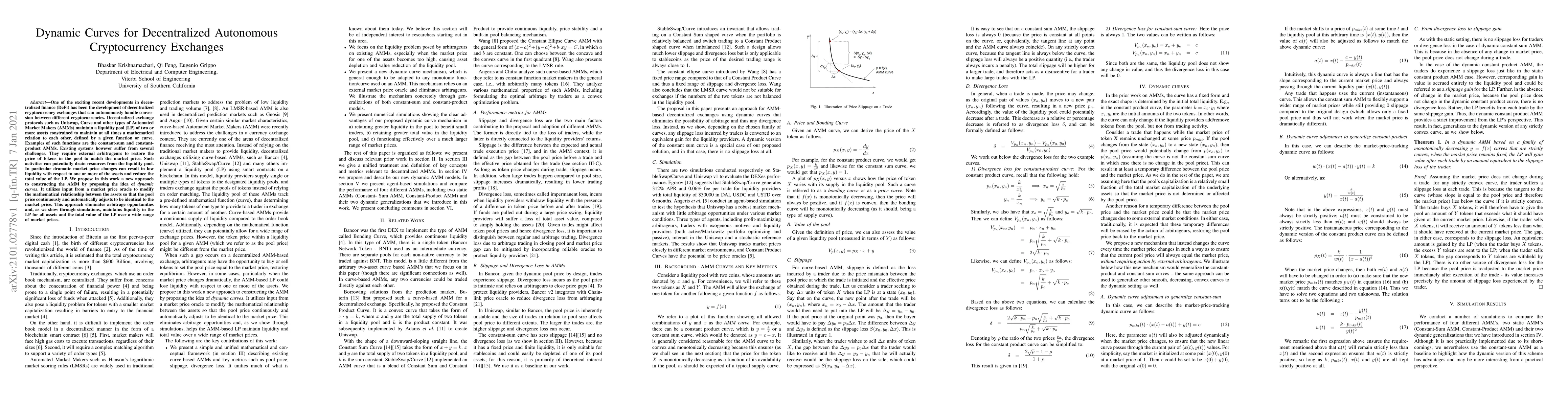

One of the exciting recent developments in decentralized finance (DeFi) has been the development of decentralized cryptocurrency exchanges that can autonomously handle conversion between different cryptocurrencies. Decentralized exchange protocols such as Uniswap, Curve and other types of Automated Market Makers (AMMs) maintain a liquidity pool (LP) of two or more assets constrained to maintain at all times a mathematical relation to each other, defined by a given function or curve. Examples of such functions are the constant-sum and constant-product AMMs. Existing systems however suffer from several challenges. They require external arbitrageurs to restore the price of tokens in the pool to match the market price. Such activities can potentially drain resources from the liquidity pool. In particular, dramatic market price changes can result in low liquidity with respect to one or more of the assets and reduce the total value of the LP. We propose in this work a new approach to constructing the AMM by proposing the idea of dynamic curves. It utilizes input from a market price oracle to modify the mathematical relationship between the assets so that the pool price continuously and automatically adjusts to be identical to the market price. This approach eliminates arbitrage opportunities and, as we show through simulations, maintains liquidity in the LP for all assets and the total value of the LP over a wide range of market prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersToward Understanding the Use of Centralized Exchanges for Decentralized Cryptocurrency

Bohui Shen, Zhixuan Zhou

Trust Dynamics and Market Behavior in Cryptocurrency: A Comparative Study of Centralized and Decentralized Exchanges

Luyao Zhang, Xintong Wu, Wanling Deng et al.

On The Quality Of Cryptocurrency Markets: Centralized Versus Decentralized Exchanges

Andrea Barbon, Angelo Ranaldo

| Title | Authors | Year | Actions |

|---|

Comments (0)