Authors

Summary

Decentralized exchange platforms such as Uniswap and Balancer operate on several pools where each pool contains two or more cryptocurrencies and constitutes direct trading pairs. The drawbacks here are that liquidity providing requires contribution of tokens in a specific proportion, and trading may require hopping between pools, hence increasing transaction fee and gas fee. We propose an automated market maker (AMM) protocol where liquidity providers can deposit any amount of tokens into the pool. The protocol will preserve the proportion of tokens by total value at the time of deposit and can be seen as a personalized self-balancing portfolio manager. In addition, since the invariant function is dynamic, all exchange pairs are executed from a single composite pool. Nevertheless, the scheme is vulnerable to flash loan attacks and must be used in conjunction with preventive measures.

AI Key Findings

Generated Aug 01, 2025

Methodology

The research proposes an automated market maker (AMM) protocol, Dynamic Exponent Market Maker (DEMM), which allows liquidity providers to deposit tokens in any proportion, including one-sided, and maintains the total token value ratio for each user through arbitraging. The protocol uses a single pool for all tradable assets, facilitating direct swaps and lower price impact.

Key Results

- DEMM preserves the ratio of the total value of tokens at the time of deposit, given there is no arbitrage opportunity.

- The protocol allows for partial liquidity provision, enabling users to deposit tokens in any amount and proportion.

- DEMM can be seen as a personalized self-balancing portfolio manager, dynamically adjusting the exponent of the invariant function based on incoming funds.

- The single composite pool reduces transaction fees and gas fees associated with hopping between pools in traditional AMMs.

- The protocol is vulnerable to flash loan attacks, necessitating preventive measures.

Significance

This research is significant as it introduces a flexible and efficient AMM protocol that addresses limitations of existing models, such as the need for specific token proportions and the requirement to hop between pools. DEMM's ability to accommodate partial liquidity provision and maintain personalized token value ratios could enhance user experience and liquidity in decentralized exchanges.

Technical Contribution

The paper presents the Dynamic Exponent Market Maker (DEMM) protocol, which introduces a flexible and adaptive constant product formula with a dynamic exponent, allowing for personalized portfolio management within a single composite pool.

Novelty

DEMM's novelty lies in its ability to accommodate partial and variable liquidity provision, dynamically adjust the exponent of the invariant function, and maintain personalized token value ratios for users, all within a single pool. This contrasts with traditional AMMs that require fixed token proportions and multiple pools for different trading pairs.

Limitations

- The protocol is susceptible to flash loan attacks, which could drain tokens from the pool and unfairly benefit attackers.

- The complexity of the dynamic exponent function might introduce additional computational costs and potential vulnerabilities.

Future Work

- Investigate and implement robust preventive measures against flash loan attacks.

- Explore optimizations to reduce computational costs associated with the dynamic exponent function.

- Analyze the performance of DEMM in comparison to existing AMMs under various market conditions.

Paper Details

PDF Preview

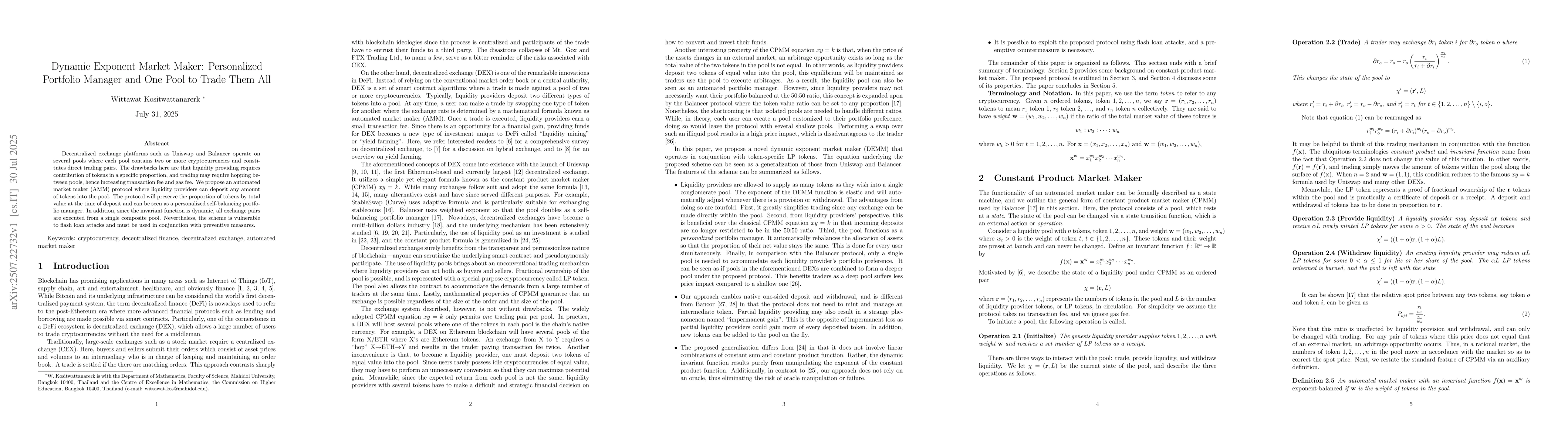

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersam-AMM: An Auction-Managed Automated Market Maker

Ciamac C. Moallemi, Dan Robinson, Austin Adams et al.

Liquidity Pool Design on Automated Market Makers

Chen Yang, Xue Dong He, Yutian Zhou

No citations found for this paper.

Comments (0)