Summary

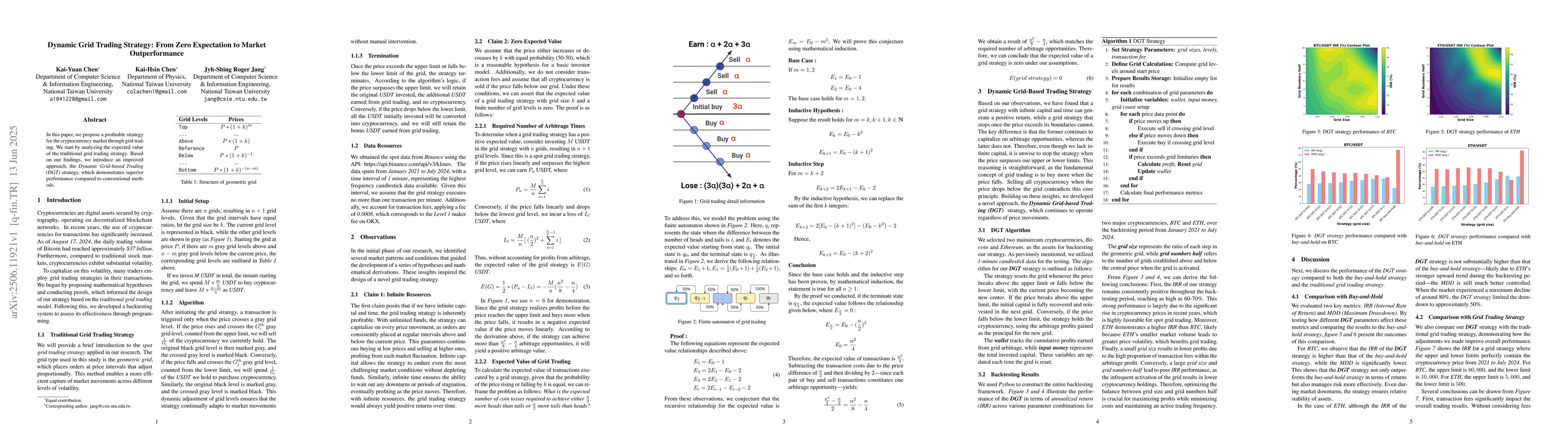

We propose a profitable trading strategy for the cryptocurrency market based on grid trading. Starting with an analysis of the expected value of the traditional grid strategy, we show that under simple assumptions, its expected return is essentially zero. We then introduce a novel Dynamic Grid-based Trading (DGT) strategy that adapts to market conditions by dynamically resetting grid positions. Our backtesting results using minute-level data from Bitcoin and Ethereum between January 2021 and July 2024 demonstrate that the DGT strategy significantly outperforms both the traditional grid and buy-and-hold strategies in terms of internal rate of return and risk control.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research proposes a Dynamic Grid-based Trading (DGT) strategy for cryptocurrency markets, analyzing its performance against traditional grid trading and buy-and-hold strategies using minute-level data from Bitcoin and Ethereum between January 2021 and July 2024.

Key Results

- The traditional grid trading strategy has essentially zero expected return under simple assumptions.

- The DGT strategy significantly outperforms both the traditional grid and buy-and-hold strategies in terms of internal rate of return (IRR) and risk control, achieving annualized returns of 60-70% for Bitcoin (BTC) and Ethereum (ETH).

- For BTC, the DGT strategy's IRR is higher, and its Maximum Drawdown (MDD) is significantly lower compared to the buy-and-hold strategy.

- The DGT strategy outperforms the traditional grid trading strategy, even when applied to a grid with predefined cryptocurrency price boundaries.

- Smaller grid sizes result in lower profits due to high transaction fees, while larger grid sizes lead to poor IRR performance due to infrequent grid activations.

Significance

This research is important as it addresses the inherent risk of losing money in traditional grid trading strategies without considering market trends. The DGT strategy provides a more effective approach for cryptocurrency traders by dynamically adapting to market conditions and reinvesting profits.

Technical Contribution

The Dynamic Grid-based Trading (DGT) strategy, which adapts to market conditions by dynamically resetting grid positions, significantly outperforms traditional grid trading and buy-and-hold strategies.

Novelty

The DGT strategy introduces dynamic grid resets based on market conditions, unlike traditional grid trading strategies that stop once prices exceed boundaries. This adaptability allows the DGT strategy to capitalize on arbitrage opportunities and reinvest profits, leading to better performance.

Limitations

- The study assumes equal probability (50-50) of price increase or decrease, which may not hold in real-world scenarios.

- Transaction fees were considered but might not fully capture the real-world costs and slippage in high-volume trades.

Future Work

- Derive the probability of profit and expected return for the DGT strategy using mathematical theory.

- Investigate the performance of the DGT strategy on other cryptocurrencies and during various market conditions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Operating Envelopes Embedded Peer-to-Peer-to-Grid Energy Trading

Hongbin Sun, Ye Guo, Zhisen Jiang et al.

No citations found for this paper.

Comments (0)