Summary

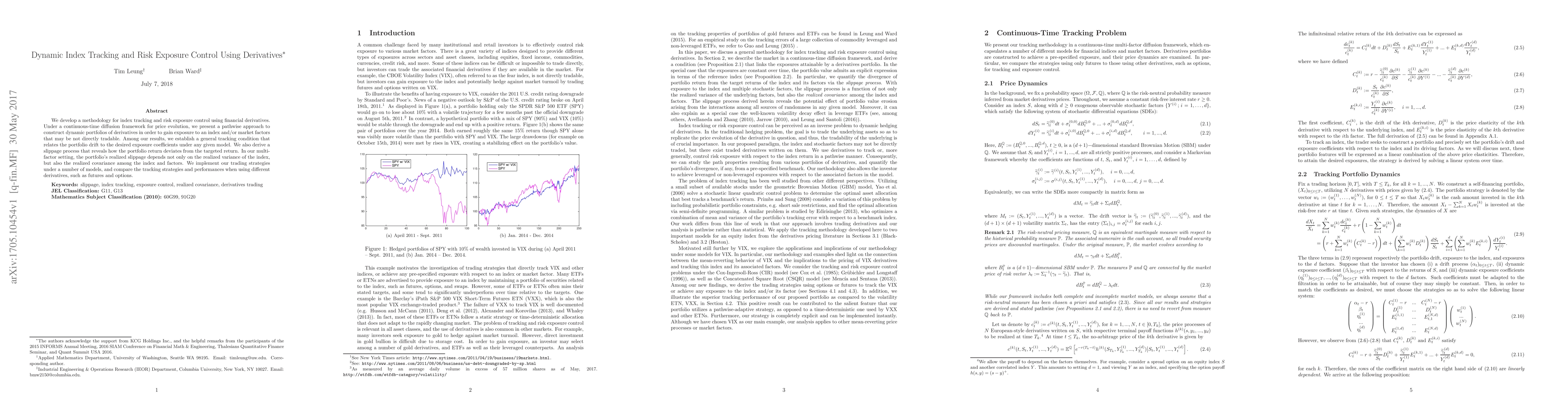

We develop a methodology for index tracking and risk exposure control using financial derivatives. Under a continuous-time diffusion framework for price evolution, we present a pathwise approach to construct dynamic portfolios of derivatives in order to gain exposure to an index and/or market factors that may be not directly tradable. Among our results, we establish a general tracking condition that relates the portfolio drift to the desired exposure coefficients under any given model. We also derive a slippage process that reveals how the portfolio return deviates from the targeted return. In our multi-factor setting, the portfolio's realized slippage depends not only on the realized variance of the index, but also the realized covariance among the index and factors. We implement our trading strategies under a number of models, and compare the tracking strategies and performances when using different derivatives, such as futures and options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-Aware Robot Control in Dynamic Environments Using Belief Control Barrier Functions

Jana Tumova, Matti Vahs, Shaohang Han

Trajectory tracking model-following control using Lyapunov redesign with output time-derivatives to compensate unmatched uncertainties

Johann Reger, Kai Wulff, Niclas Tietze

| Title | Authors | Year | Actions |

|---|

Comments (0)