Authors

Summary

Traditional statistical estimation, or statistical inference in general, is static, in the sense that the estimate of the quantity of interest does not change the future evolution of the quantity. In some sequential estimation problems however, we encounter the situation where the future values of the quantity to be estimated depend on the estimate of its current value. Examples include stock price prediction by big investors, interactive product recommendation, and behavior prediction in multi-agent systems. We may call such problems as dynamic inference. In this work, a formulation of this problem under a Bayesian probabilistic framework is given, and the optimal estimation strategy is derived as the solution to minimize the overall inference loss. How the optimal estimation strategy works is illustrated through two examples, stock trend prediction and vehicle behavior prediction. When the underlying models for dynamic inference are unknown, we can consider the problem of learning for dynamic inference. This learning problem can potentially unify several familiar machine learning problems, including supervised learning, imitation learning, and reinforcement learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

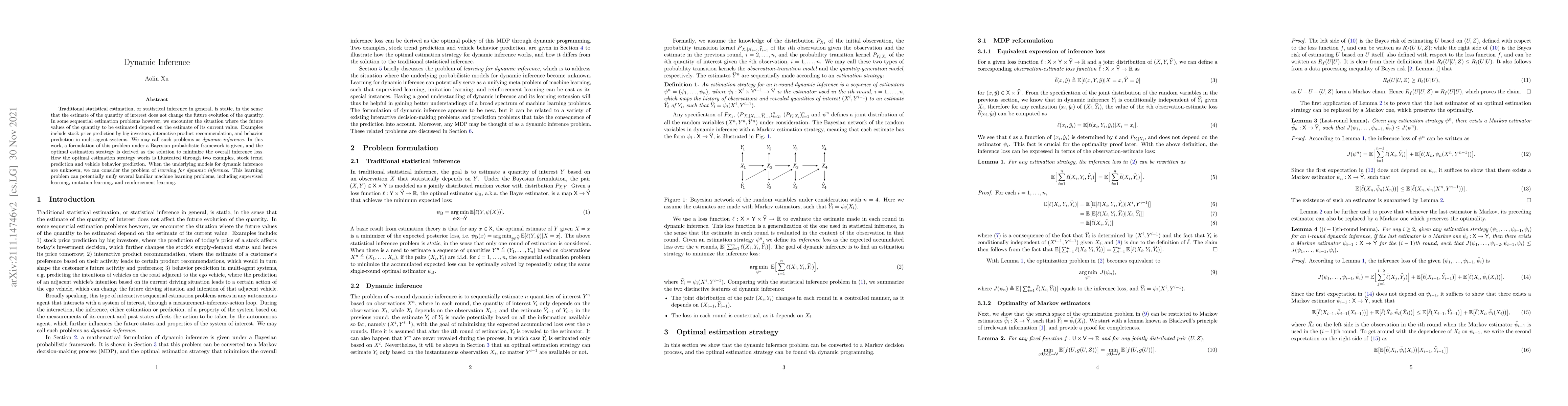

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)