Summary

We study the problem of designing dynamic intervention policies for minimizing networked defaults in financial networks. Formally, we consider a dynamic version of the celebrated Eisenberg-Noe model of financial network liabilities and use this to study the design of external intervention policies. Our controller has a fixed resource budget in each round and can use this to minimize the effect of demand/supply shocks in the network. We formulate the optimal intervention problem as a Markov Decision Process and show how we can leverage the problem structure to efficiently compute optimal intervention policies with continuous interventions and provide approximation algorithms for discrete interventions. Going beyond financial networks, we argue that our model captures dynamic network intervention in a much broader class of dynamic demand/supply settings with networked inter-dependencies. To demonstrate this, we apply our intervention algorithms to various application domains, including ridesharing, online transaction platforms, and financial networks with agent mobility. In each case, we study the relationship between node centrality and intervention strength, as well as the fairness properties of the optimal interventions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

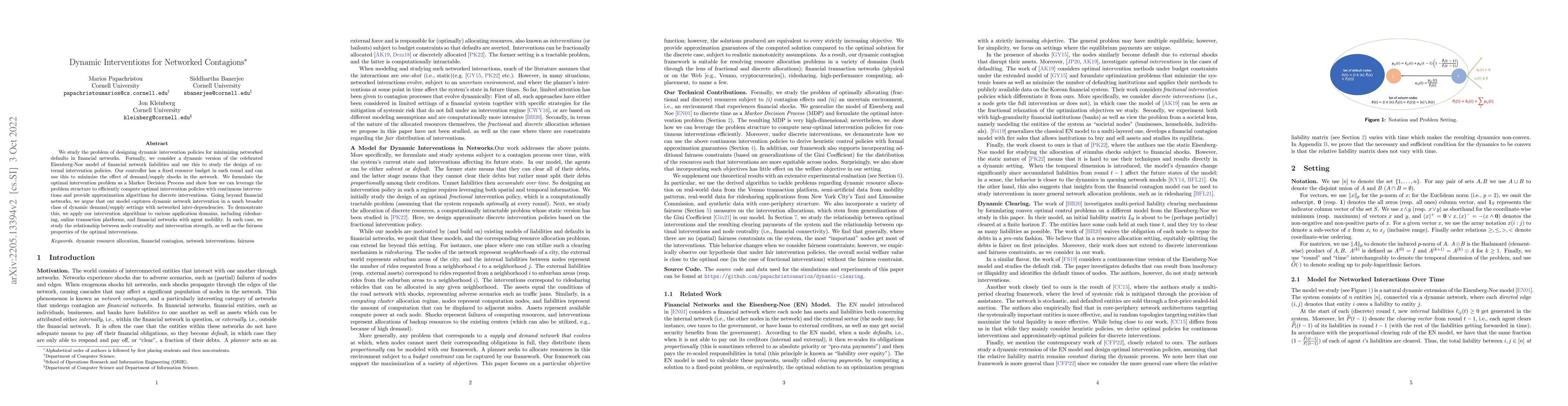

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComplex contagions can outperform simple contagions for network reconstruction with dense networks or saturated dynamics

Jean-Gabriel Young, Nicholas W. Landry, William Thompson et al.

Networked Restless Multi-Armed Bandits for Mobile Interventions

Milind Tambe, Yevgeniy Vorobeychik, David Kempe et al.

Latent Dynamic Networked System Identification with High-Dimensional Networked Data

Jiaxin Yu, Yanfang Mo, S. Joe Qin

Neuro-Dynamic State Estimation for Networked Microgrids

Peng Zhang, Yifan Zhou, Fei Feng

| Title | Authors | Year | Actions |

|---|

Comments (0)