Authors

Summary

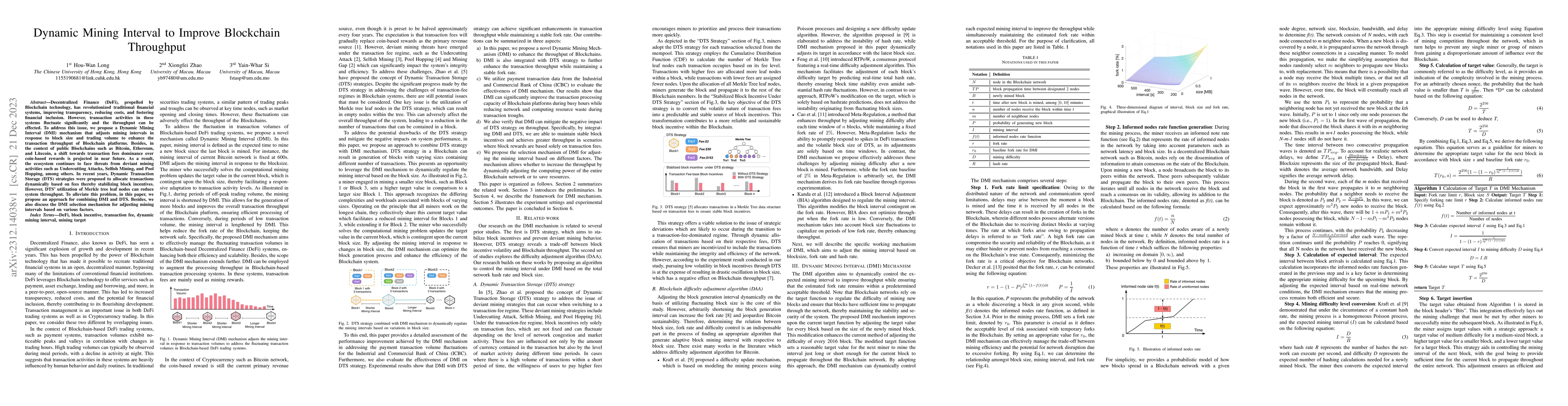

Decentralized Finance (DeFi), propelled by Blockchain technology, has revolutionized traditional financial systems, improving transparency, reducing costs, and fostering financial inclusion. However, transaction activities in these systems fluctuate significantly and the throughput can be effected. To address this issue, we propose a Dynamic Mining Interval (DMI) mechanism that adjusts mining intervals in response to block size and trading volume to enhance the transaction throughput of Blockchain platforms. Besides, in the context of public Blockchains such as Bitcoin, Ethereum, and Litecoin, a shift towards transaction fees dominance over coin-based rewards is projected in near future. As a result, the ecosystem continues to face threats from deviant mining activities such as Undercutting Attacks, Selfish Mining, and Pool Hopping, among others. In recent years, Dynamic Transaction Storage (DTS) strategies were proposed to allocate transactions dynamically based on fees thereby stabilizing block incentives. However, DTS' utilization of Merkle tree leaf nodes can reduce system throughput. To alleviate this problem, in this paper, we propose an approach for combining DMI and DTS. Besides, we also discuss the DMI selection mechanism for adjusting mining intervals based on various factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollaborative Proof-of-Work: A Secure Dynamic Approach to Fair and Efficient Blockchain Mining

Faisal Haque Bappy, Tariqul Islam, Rizwanul Haque et al.

Manifoldchain: Maximizing Blockchain Throughput via Bandwidth-Clustered Sharding

Xuechao Wang, Songze Li, Chunjiang Che

| Title | Authors | Year | Actions |

|---|

Comments (0)