Summary

We propose a general dynamic model averaging (DMA) approach based on Markov-Chain Monte Carlo for the sequential combination and estimation of quantile regression models with time-varying parameters. The efficiency and the effectiveness of the proposed DMA approach and the MCMC algorithm are shown through simulation studies and applications to macro-economics and finance.

AI Key Findings

Generated Sep 03, 2025

Methodology

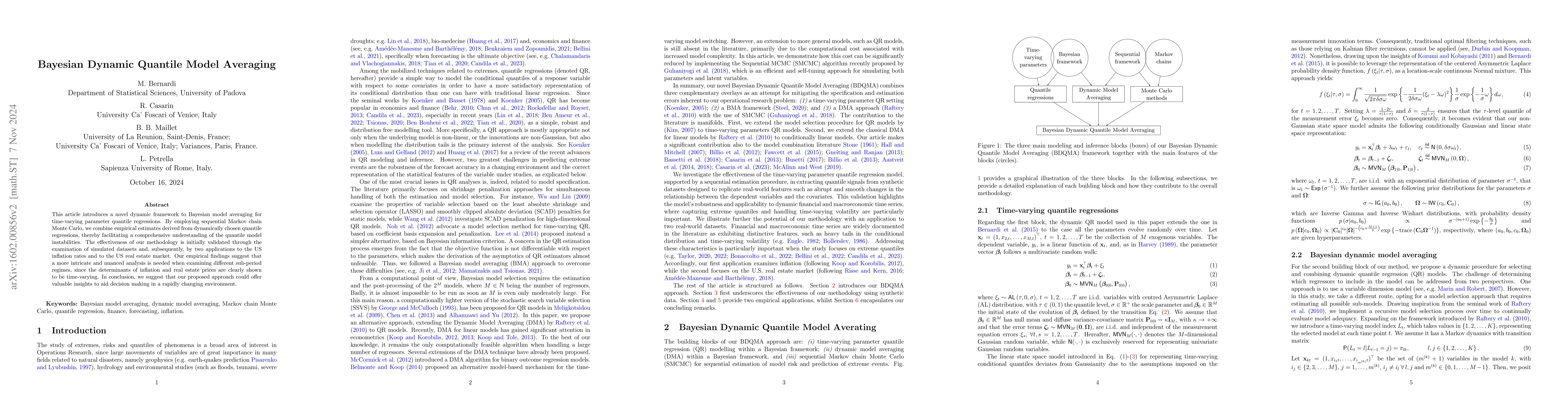

The paper proposes a Dynamic Model Averaging (DMA) approach for Bayesian quantile regression, utilizing Markov-Chain Monte Carlo (MCMC) for sequential combination and estimation of time-varying parameter models.

Key Results

- The DMA approach demonstrates efficiency and effectiveness through simulation studies and applications in macro-economics and finance.

- The method successfully handles time-varying parameters and quantile regression, providing robust forecasts across different economic conditions.

Significance

This research contributes to the field by offering a novel approach for Bayesian quantile regression, which is crucial for understanding the conditional distribution of economic and financial time series data, thereby aiding in better risk management and policy decisions.

Technical Contribution

The paper introduces a novel Bayesian Dynamic Quantile Model Averaging (BDQMA) approach, combining Bayesian time-varying quantile regressions and dynamic model averaging in a tractable manner using Gaussian mixtures, conditional normal state-space representations, and sequential Monte Carlo methods.

Novelty

The main novelty of this work lies in its comprehensive integration of Bayesian quantile regression with dynamic model averaging, addressing model uncertainty and time-varying parameters, which sets it apart from existing static quantile regression methods and traditional dynamic model averaging techniques.

Limitations

- The paper does not explicitly discuss limitations, but potential limitations could include computational intensity due to MCMC methods and the assumption of normally distributed errors in quantile regression models.

- The approach might be sensitive to the choice of priors and tuning parameters in the MCMC algorithm.

Future Work

- Further research could explore the application of the proposed method to other fields like environmental economics or healthcare cost analysis.

- Investigating alternative MCMC methods or adaptive strategies to improve computational efficiency would be beneficial.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)