Summary

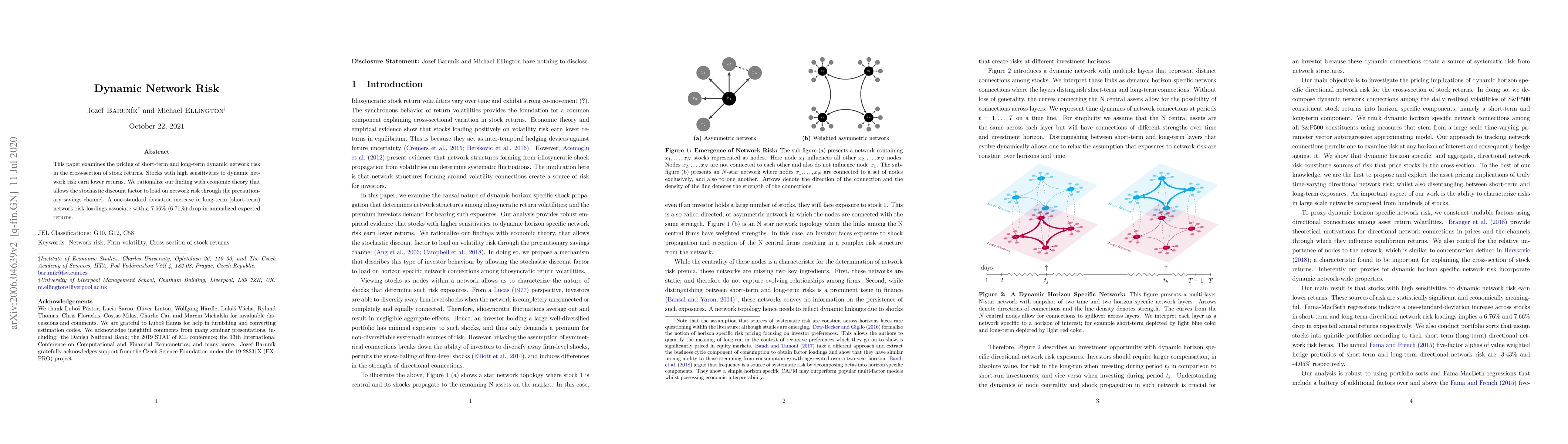

This paper examines the pricing of short-term and long-term dynamic network risk in the cross-section of stock returns. Stocks with high sensitivities to dynamic network risk earn lower returns. We rationalize our finding with economic theory that allows the stochastic discount factor to load on network risk through the precautionary savings channel. A one-standard deviation increase in long-term (short-term) network risk loadings associate with a 7.66% (6.71%) drop in annualized expected returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Budgeting Allocation for Dynamic Risk Measures

Sebastian Jaimungal, Silvana M. Pesenti, Yuri F. Saporito et al.

GenDMR: A dynamic multimodal role-swapping network for identifying risk gene phenotypes

Ying Tan, Cheng Luo, Dezhong Yao et al.

No citations found for this paper.

Comments (0)