Summary

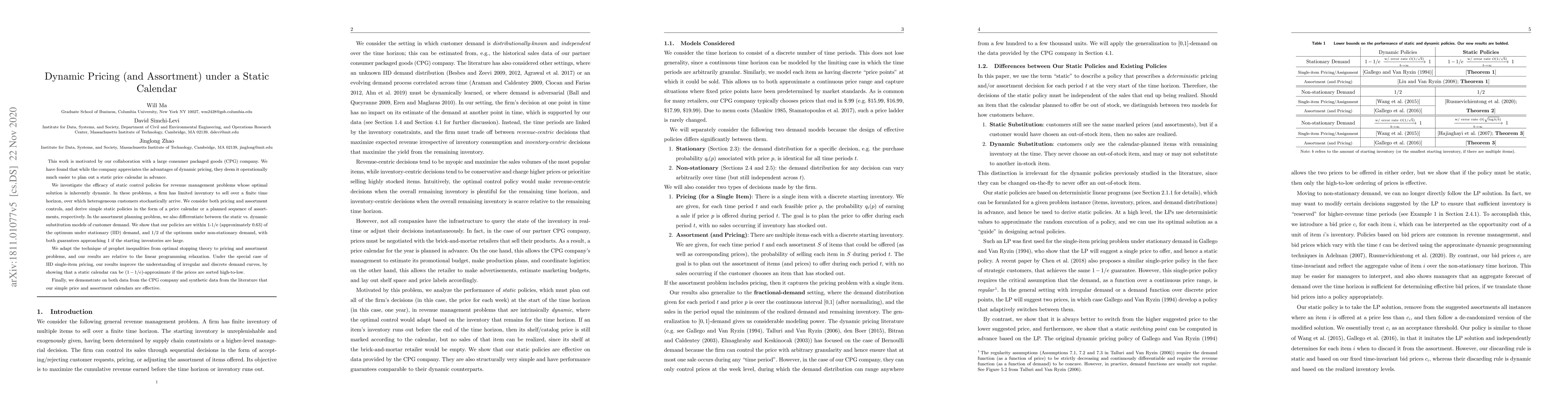

This work is motivated by our collaboration with a large consumer packaged goods (CPG) company. We have found that while the company appreciates the advantages of dynamic pricing, they deem it operationally much easier to plan out a static price calendar in advance. We investigate the efficacy of static control policies for revenue management problems whose optimal solution is inherently dynamic. In these problems, a firm has limited inventory to sell over a finite time horizon, over which heterogeneous customers stochastically arrive. We consider both pricing and assortment controls, and derive simple static policies in the form of a price calendar or a planned sequence of assortments, respectively. In the assortment planning problem, we also differentiate between the static vs. dynamic substitution models of customer demand. We show that our policies are within 1-1/e (approximately 0.63) of the optimum under stationary (IID) demand, and 1/2 of the optimum under non-stationary demand, with both guarantees approaching 1 if the starting inventories are large. We adapt the technique of prophet inequalities from optimal stopping theory to pricing and assortment problems, and our results are relative to the linear programming relaxation. Under the special case of IID single-item pricing, our results improve the understanding of irregular and discrete demand curves, by showing that a static calendar can be (1-1/e)-approximate if the prices are sorted high-to-low. Finally, we demonstrate on both data from the CPG company and synthetic data from the literature that our simple price and assortment calendars are effective.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic pricing and assortment under a contextual MNL demand

Noemie Perivier, Vineet Goyal

Fairness-Aware Static and Dynamic Assortment Optimization: Optimal Selection with Balanced Market Share

Qing Feng, Omar El Housni, Huseyin Topaloglu

Dynamic Assortment Selection and Pricing with Censored Preference Feedback

Min-hwan Oh, Jung-hun Kim

| Title | Authors | Year | Actions |

|---|

Comments (0)