Summary

We consider the problem of dynamic pricing with limited supply. A seller has $k$ identical items for sale and is facing $n$ potential buyers ("agents") that are arriving sequentially. Each agent is interested in buying one item. Each agent's value for an item is an IID sample from some fixed distribution with support $[0,1]$. The seller offers a take-it-or-leave-it price to each arriving agent (possibly different for different agents), and aims to maximize his expected revenue. We focus on "prior-independent" mechanisms -- ones that do not use any information about the distribution. They are desirable because knowing the distribution is unrealistic in many practical scenarios. We study how the revenue of such mechanisms compares to the revenue of the optimal offline mechanism that knows the distribution ("offline benchmark"). We present a prior-independent dynamic pricing mechanism whose revenue is at most $O((k \log n)^{2/3})$ less than the offline benchmark, for every distribution that is regular. In fact, this guarantee holds without *any* assumptions if the benchmark is relaxed to fixed-price mechanisms. Further, we prove a matching lower bound. The performance guarantee for the same mechanism can be improved to $O(\sqrt{k} \log n)$, with a distribution-dependent constant, if $k/n$ is sufficiently small. We show that, in the worst case over all demand distributions, this is essentially the best rate that can be obtained with a distribution-specific constant. On a technical level, we exploit the connection to multi-armed bandits (MAB). While dynamic pricing with unlimited supply can easily be seen as an MAB problem, the intuition behind MAB approaches breaks when applied to the setting with limited supply. Our high-level conceptual contribution is that even the limited supply setting can be fruitfully treated as a bandit problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

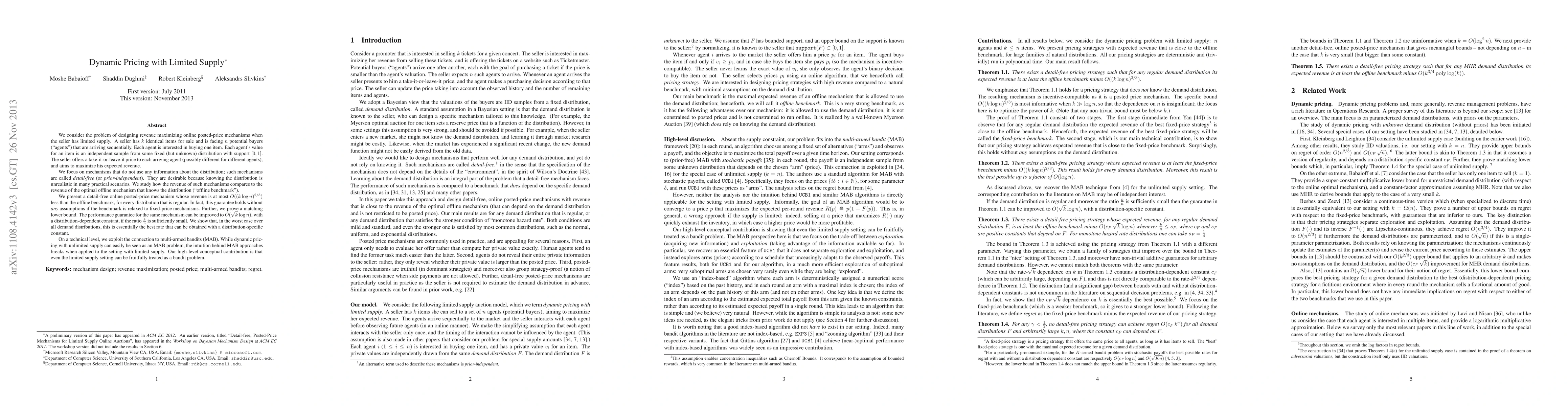

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMatching of Everyday Power Supply and Demand with Dynamic Pricing: Problem Formalisation and Conceptual Analysis

Damien Ernst, Thibaut Théate, Antonio Sutera

| Title | Authors | Year | Actions |

|---|

Comments (0)