Summary

Prize linked savings accounts provide a return in the form of randomly chosen accounts receiving large cash prizes, in lieu of a guaranteed and uniform interest rate. This model became legal for American national banks upon bipartisan passage of the American Savings Promotion Act in December 2014, and many states have deregulated this option for state chartered banks and credit unions in recent years. Prize linked savings programs have unique appeal and proven societal benefits, but the product is still not available to the vast majority of Americans. There is demonstrated interest in these products, but the supply side may be the bottleneck, because the prevailing consensus is that prize linked savings primarily appeal to low income consumers. This paper examines a less common, dynamic prize, model of prize linked savings and shows why it might result in a larger average account size. The paper proposes three methods of managing risk under this model, and tests two of them using a Monte Carlo simulation. We conclude that both tested methods are effective at mitigating the most severe risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

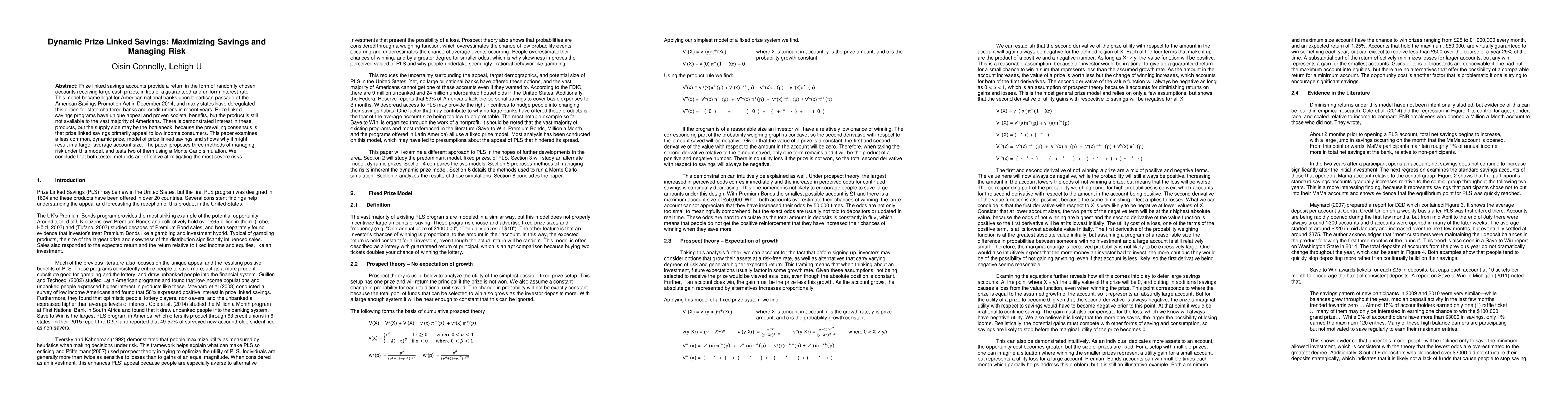

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)