Authors

Summary

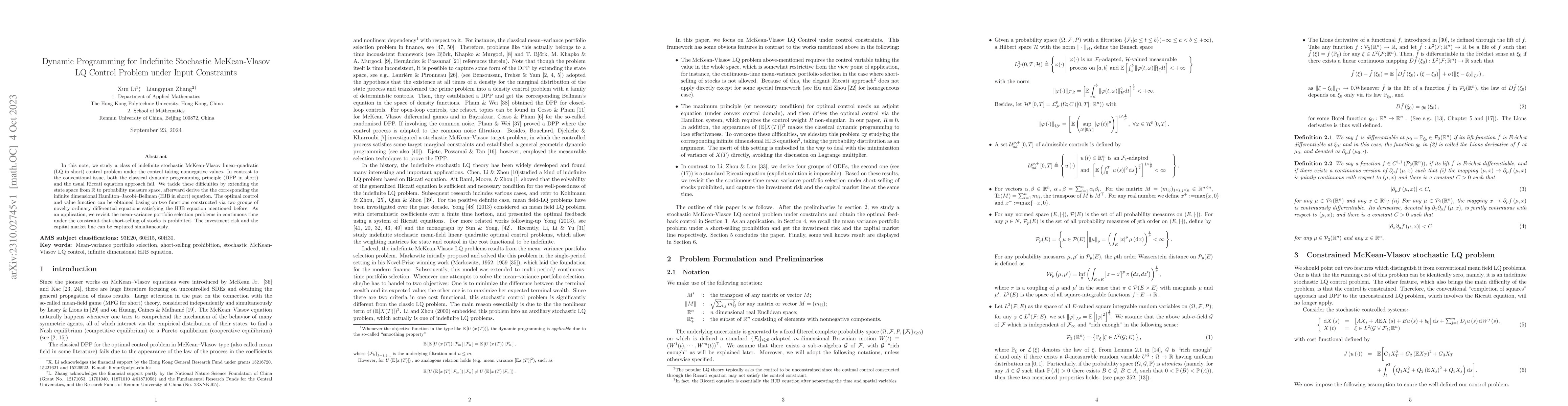

In this note, we study a class of indefinite stochastic McKean-Vlasov linear-quadratic (LQ in short) control problem under the control taking nonnegative values. In contrast to the conventional issue, both the classical dynamic programming principle (DPP in short) and the usual Riccati equation approach fail. We tackle these difficulties by extending the state space from $\mathbb{R}$ to probability measure space, afterward derive the the corresponding the infinite dimensional Hamilton--Jacobi--Bellman (HJB in short) equation. The optimal control and value function can be obtained basing on two functions constructed via two groups of novelty ordinary differential equations satisfying the HJB equation mentioned before. As an application, we revisit the mean-variance portfolio selection problems in continuous time under the constraint that short-selling of stocks is prohibited. The investment risk and the capital market line can be captured simultaneously.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)