Authors

Summary

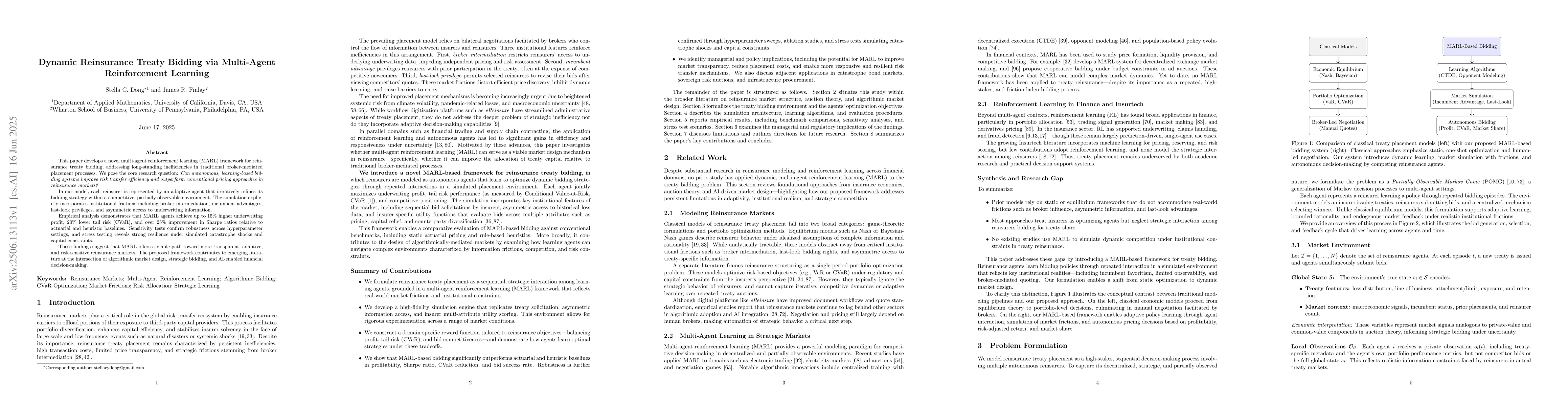

This paper develops a novel multi-agent reinforcement learning (MARL) framework for reinsurance treaty bidding, addressing long-standing inefficiencies in traditional broker-mediated placement processes. We pose the core research question: Can autonomous, learning-based bidding systems improve risk transfer efficiency and outperform conventional pricing approaches in reinsurance markets? In our model, each reinsurer is represented by an adaptive agent that iteratively refines its bidding strategy within a competitive, partially observable environment. The simulation explicitly incorporates institutional frictions including broker intermediation, incumbent advantages, last-look privileges, and asymmetric access to underwriting information. Empirical analysis demonstrates that MARL agents achieve up to 15% higher underwriting profit, 20% lower tail risk (CVaR), and over 25% improvement in Sharpe ratios relative to actuarial and heuristic baselines. Sensitivity tests confirm robustness across hyperparameter settings, and stress testing reveals strong resilience under simulated catastrophe shocks and capital constraints. These findings suggest that MARL offers a viable path toward more transparent, adaptive, and risk-sensitive reinsurance markets. The proposed framework contributes to emerging literature at the intersection of algorithmic market design, strategic bidding, and AI-enabled financial decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHierarchical Multi-agent Meta-Reinforcement Learning for Cross-channel Bidding

Chao Yu, Shenghong He

ClauseLens: Clause-Grounded, CVaR-Constrained Reinforcement Learning for Trustworthy Reinsurance Pricing

Stella C. Dong, James R. Finlay

No citations found for this paper.

Comments (0)