Summary

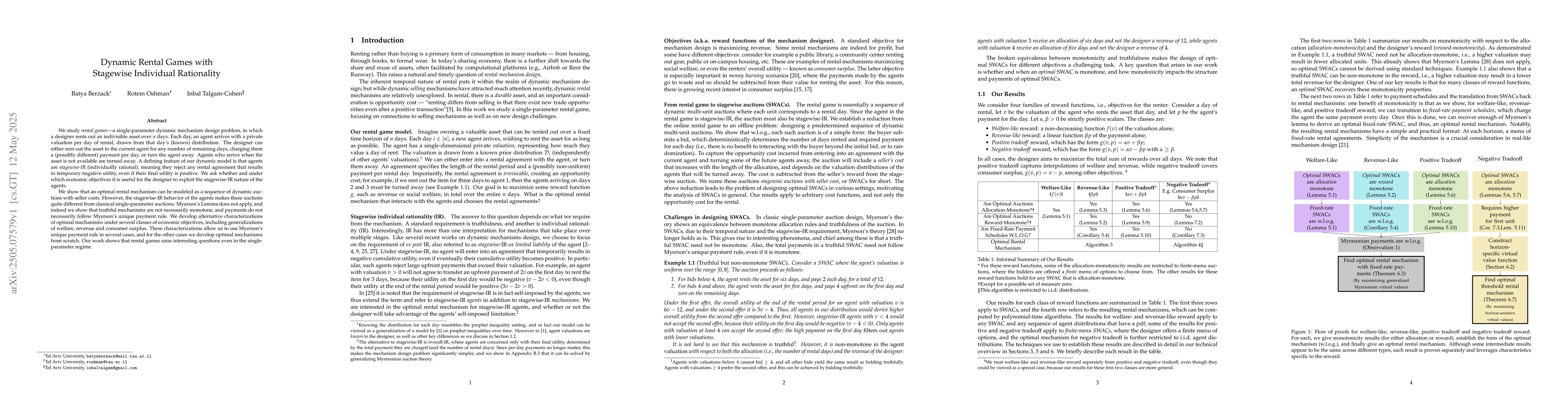

We study \emph{rental games} -- a single-parameter dynamic mechanism design problem, in which a designer rents out an indivisible asset over $n$ days. Each day, an agent arrives with a private valuation per day of rental, drawn from that day's (known) distribution. The designer can either rent out the asset to the current agent for any number of remaining days, charging them a (possibly different) payment per day, or turn the agent away. Agents who arrive when the asset is not available are turned away. A defining feature of our dynamic model is that agents are \emph{stagewise-IR} (individually rational), meaning they reject any rental agreement that results in temporary negative utility, even if their final utility is positive. We ask whether and under which economic objectives it is useful for the designer to exploit the stagewise-IR nature of the agents. We show that an optimal rental mechanism can be modeled as a sequence of dynamic auctions with seller costs. However, the stagewise-IR behavior of the agents makes these auctions quite different from classical single-parameter auctions: Myerson's Lemma does not apply, and indeed we show that truthful mechanisms are not necessarily monotone, and payments do not necessarily follow Myerson's unique payment rule. We develop alternative characterizations of optimal mechanisms under several classes of economic objectives, including generalizations of welfare, revenue and consumer surplus. These characterizations allow us to use Myerson's unique payment rule in several cases, and for the other cases we develop optimal mechanisms from scratch. Our work shows that rental games raise interesting questions even in the single-parameter regime.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs a dynamic mechanism design approach to analyze rental games, modeling optimal rental mechanisms as a sequence of dynamic auctions with seller costs. It investigates the impact of stagewise-IR behavior on these auctions, showing that classical auction theory principles like Myerson's Lemma do not directly apply.

Key Results

- Optimal rental mechanisms can be characterized as dynamic auctions with seller costs, despite the deviation from classical auction rules due to stagewise-IR behavior.

- Truthful mechanisms aren't necessarily monotone, and payments don't follow Myerson's unique payment rule in this context.

- Alternative characterizations of optimal mechanisms are developed for various economic objectives, including welfare, revenue, and consumer surplus generalizations.

Significance

This study is important as it explores the implications of stagewise-IR behavior in single-parameter dynamic mechanism design, revealing that rental games present unique challenges and opportunities beyond traditional auction theory.

Technical Contribution

The paper presents alternative characterizations of optimal mechanisms for dynamic rental games under stagewise-IR constraints, along with mechanisms designed specifically for this context, bypassing the applicability of Myerson's Lemma.

Novelty

The work distinguishes itself by examining the single-parameter regime of dynamic rental games with stagewise-IR agents, revealing that standard auction theory principles do not hold and proposing new characterizations and mechanisms tailored to this specific setting.

Limitations

- The research does not address multi-parameter settings or more complex agent behaviors.

- Findings are specific to single-parameter dynamic environments and may not generalize easily to other contexts.

Future Work

- Investigate the extension of these results to multi-parameter and more complex agent behavior models.

- Explore the applicability of the developed mechanisms and characterizations in real-world rental scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersLearning Rationality in Potential Games

Jaime Fernández Fisac, Bartolomeo Stellato, Gabriele Dragotto et al.

Individual Rationality Conditions of Identifying Matching Costs in Transferable Utility Matching Games

Suguru Otani

Bayesian Rationality in Satisfaction Games

Duong Nguyen, Hung Nguyen, Langford White et al.

No citations found for this paper.

Comments (0)