Summary

A celebrated financial application of convex duality theory gives an explicit relation between the following two quantities: (i) The optimal terminal wealth $X^*(T) : = X_{\varphi^*}(T)$ of the problem to maximize the expected $U$-utility of the terminal wealth $X_{\varphi}(T)$ generated by admissible portfolios $\varphi(t), 0 \leq t \leq T$ in a market with the risky asset price process modeled as a semimartingale; (ii) The optimal scenario $\frac{dQ^*}{dP}$ of the dual problem to minimize the expected $V$-value of $\frac{dQ}{dP}$ over a family of equivalent local martingale measures $Q$, where $V$ is the convex conjugate function of the concave function $U$. In this paper we consider markets modeled by It\^o-L\'evy processes. In the first part we use the maximum principle in stochastic control theory to extend the above relation to a \emph{dynamic} relation, valid for all $t \in [0,T]$. We prove in particular that the optimal adjoint process for the primal problem coincides with the optimal density process, and that the optimal adjoint process for the dual problem coincides with the optimal wealth process, $0 \leq t \leq T$. In the terminal time case $t=T$ we recover the classical duality connection above. We get moreover an explicit relation between the optimal portfolio $\varphi^*$ and the optimal measure $Q^*$. We also obtain that the existence of an optimal scenario is equivalent to the replicability of a related $T$-claim. In the second part we present robust (model uncertainty) versions of the optimization problems in (i) and (ii), and we prove a similar dynamic relation between them. In particular, we show how to get from the solution of one of the problems to the other. We illustrate the results with explicit examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

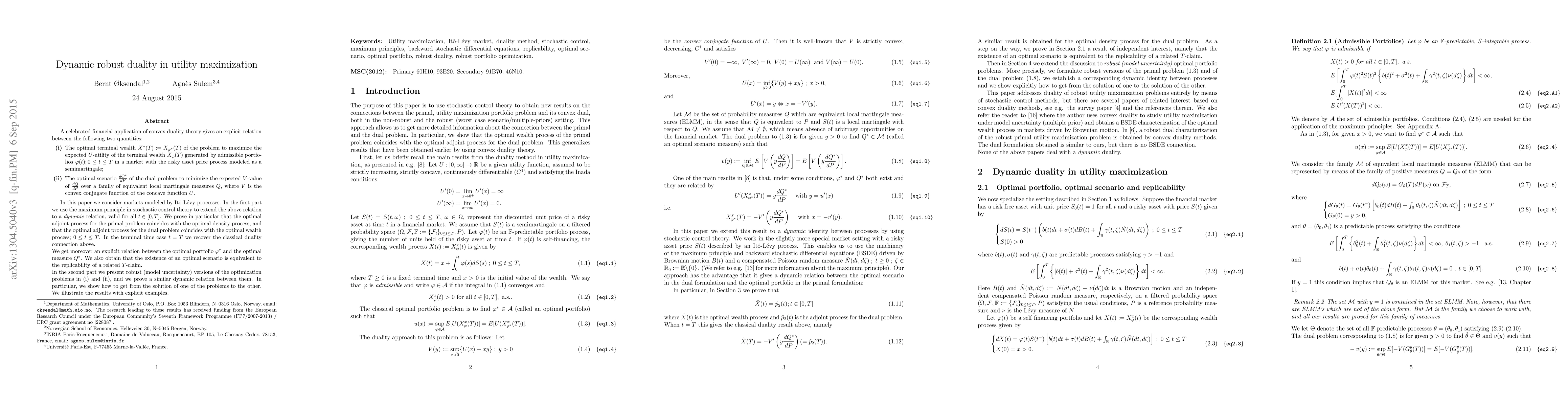

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)