Summary

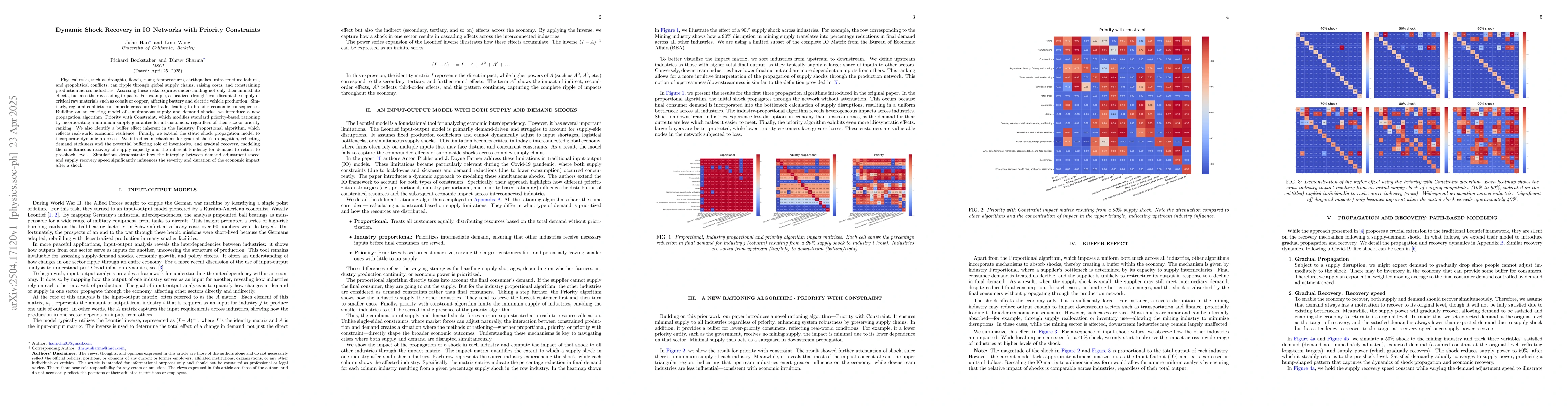

Physical risks, such as droughts, floods, rising temperatures, earthquakes, infrastructure failures, and geopolitical conflicts, can ripple through global supply chains, raising costs, and constraining production across industries. Assessing these risks requires understanding not only their immediate effects, but also their cascading impacts. For example, a localized drought can disrupt the supply of critical raw materials such as cobalt or copper, affecting battery and electric vehicle production. Similarly, regional conflicts can impede cross-border trade, leading to broader economic consequences. Building on an existing model of simultaneous supply and demand shocks, we introduce a new propagation algorithm, Priority with Constraint, which modifies standard priority-based rationing by incorporating a minimum supply guarantee for all customers, regardless of their size or priority ranking. We also identify a buffer effect inherent in the Industry Proportional algorithm, which reflects real-world economic resilience. Finally, we extend the static shock propagation model to incorporate dynamic processes. We introduce mechanisms for gradual shock propagation, reflecting demand stickiness and the potential buffering role of inventories, and gradual recovery, modeling the simultaneous recovery of supply capacity and the inherent tendency for demand to return to pre-shock levels. Simulations demonstrate how the interplay between demand adjustment speed and supply recovery speed significantly influences the severity and duration of the economic impact after a shock.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research introduces a dynamic shock propagation model in Input-Output (IO) networks, incorporating priority constraints and gradual shock propagation and recovery mechanisms.

Key Results

- The Priority with Constraint algorithm attenuates shock impacts compared to other algorithms, concentrating effects upstream in the network.

- A buffer effect is identified in the Industry Proportional algorithm, reflecting real-world economic resilience.

- Simulations show that the interplay between demand adjustment speed and supply recovery speed significantly influences the severity and duration of economic impact after a shock.

- Gradual propagation and recovery dynamics are modeled, with demand adjustment speed and supply recovery rates determining the economic shock's severity and duration.

- The study highlights the importance of connecting aggregated IO modeling with more detailed, fine-grained data for better insights into economic dynamics.

Significance

This research is significant as it offers a framework for analyzing supply shock propagation in IO networks, which is crucial for understanding systemic risks from physical risks such as climate change, geopolitical conflicts, demographic shifts, and technological disruptions.

Technical Contribution

The paper presents the Priority with Constraint algorithm, which provides a minimum supply guarantee and creates a buffering effect, highlighting critical shock propagation pathways contributing to systemic risk.

Novelty

This work stands out by extending existing Leontief framework models to include gradual shock propagation and recovery dynamics, emphasizing the roles of demand adjustment speed and supply recovery rates in determining the severity and duration of economic shocks.

Limitations

- The aggregated and coarse-grained nature of underlying data presents limitations, as it does not capture the nuances experienced at the individual firm level.

- Timescales of adjustments and impacts at the sectoral level differ significantly from those experienced at the individual firm level.

Future Work

- Connecting the aggregated IO perspective with more detailed, fine-grained data, ideally at the single firm level, is essential.

- Further research should explore the creation of physical risk scenarios for financial stress testing by explicitly modeling physical disruptions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)