Authors

Summary

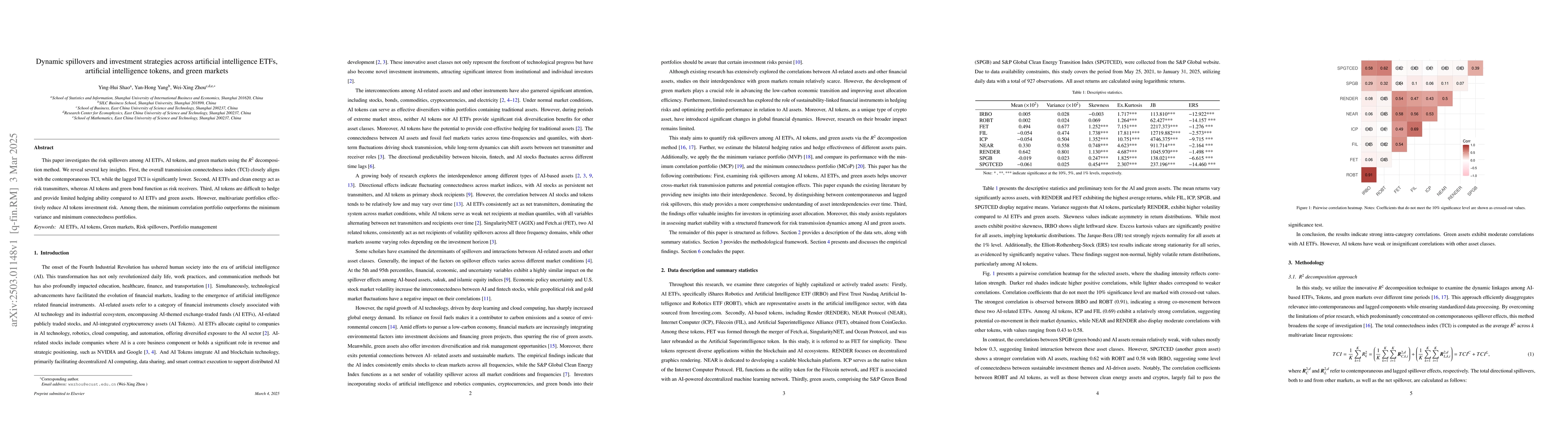

This paper investigates the risk spillovers among AI ETFs, AI tokens, and green markets using the R2 decomposition method. We reveal several key insights. First, the overall transmission connectedness index (TCI) closely aligns with the contemporaneous TCI, while the lagged TCI is significantly lower. Second, AI ETFs and clean energy act as risk transmitters, whereas AI tokens and green bond function as risk receivers. Third, AI tokens are difficult to hedge and provide limited hedging ability compared to AI ETFs and green assets. However, multivariate portfolios effectively reduce AI tokens investment risk. Among them, the minimum correlation portfolio outperforms the minimum variance and minimum connectedness portfolios.

AI Key Findings

Generated Jun 10, 2025

Methodology

This study employs the R2 decomposition method to examine risk spillover dynamics among AI ETFs, AI tokens, and green assets.

Key Results

- Contemporaneous spillovers dominate the total connectedness index, while lagged spillovers remain relatively stable.

- AI ETFs and clean energy act as risk transmitters, whereas AI tokens and green bonds function as risk receivers.

- AI tokens are challenging to hedge and offer limited hedging ability compared to AI ETFs and green assets.

- The minimum correlation portfolio outperforms minimum variance and minimum connectedness portfolios in reducing AI tokens investment risk.

- Multivariate portfolios effectively reduce AI tokens investment risk, with the minimum correlation portfolio showing the best performance.

Significance

Understanding the risk transmission dynamics among AI ETFs, AI tokens, and green assets is crucial for investors, regulators, and policymakers to manage and mitigate systemic risks in financial markets.

Technical Contribution

This research introduces a comprehensive analysis of risk spillovers using the R2 decomposition method, providing insights into the roles of AI ETFs, AI tokens, and green assets as risk transmitters and receivers.

Novelty

The study distinguishes itself by examining the hedging effectiveness of AI tokens and green bonds, revealing that clean energy exhibits stronger hedging effectiveness, while AI tokens are challenging to hedge effectively.

Limitations

- The study focuses on a specific time period (May 25, 2021, to January 31, 2025) and may not capture long-term trends or future changes in market dynamics.

- The analysis is based on historical data and may not account for unforeseen events or regulatory changes that could impact future risk spillover patterns.

Future Work

- Investigate the impact of emerging AI technologies and their associated financial instruments on market dynamics.

- Explore the role of AI in enhancing risk management strategies and portfolio optimization techniques.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)