Authors

Summary

Motivated by the results of static monetary or star-shaped risk measures, the paper investigates the representation theorems in the dynamic framework. We show that dynamic monetary risk measures can be represented as the lower envelope of a family of dynamic convex risk measures, and normalized dynamic star-shaped risk measures can be represented as the lower envelope of a family of normalized dynamic convex risk measures. The link between dynamic monetary risk measures and dynamic star-shaped risk measures are established. Besides, the sensitivity and time consistency problems are also studied. A specific normalized time consistent dynamic star-shaped risk measures induced by $ g $-expectations are illustrated and discussed in detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

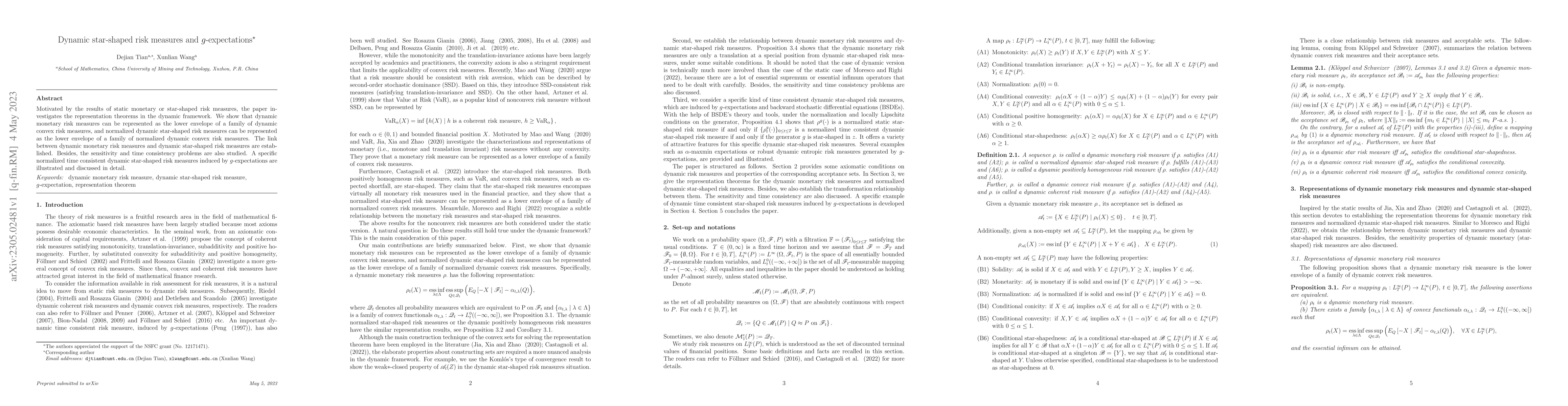

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Return and Star-Shaped Risk Measures via BSDEs

Emanuela Rosazza Gianin, Roger J. A. Laeven, Marco Zullino

| Title | Authors | Year | Actions |

|---|

Comments (0)