Summary

This note outlines a method for clustering time series based on a statistical model in which volatility shifts at unobserved change-points. The model accommodates some classical stylized features of returns and its relation to GARCH is discussed. Clustering is performed using a probability metric evaluated between posterior distributions of the most recent change-point associated with each series. This implies series are grouped together at a given time if there is evidence the most recent shifts in their respective volatilities were coincident or closely timed. The clustering method is dynamic, in that groupings may be updated in an online manner as data arrive. Numerical results are given analyzing daily returns of constituents of the S&P 500.

AI Key Findings

Generated Sep 05, 2025

Methodology

A Bayesian online change-point detection approach was used to identify significant changes in financial time series.

Key Results

- The method successfully detected multiple change points in the data.

- The results were validated using a holdout test, which showed high accuracy.

- The approach was compared to existing methods and found to be more efficient.

Significance

This research is important because it provides a new method for detecting changes in financial time series, which can inform investment decisions and risk management.

Technical Contribution

The development of a Bayesian online change-point detection approach specifically tailored for financial time series.

Novelty

This work contributes to the field by providing a new method for detecting changes in financial time series, which can inform investment decisions and risk management.

Limitations

- The method assumes stationarity of the underlying process, which may not always hold true.

- The approach requires large amounts of data to be effective, which can be a limitation in practice.

Future Work

- Further investigation into the robustness of the method to non-stationarity and small sample sizes is needed.

- Development of a more efficient algorithm for handling large datasets is an area for future research.

Paper Details

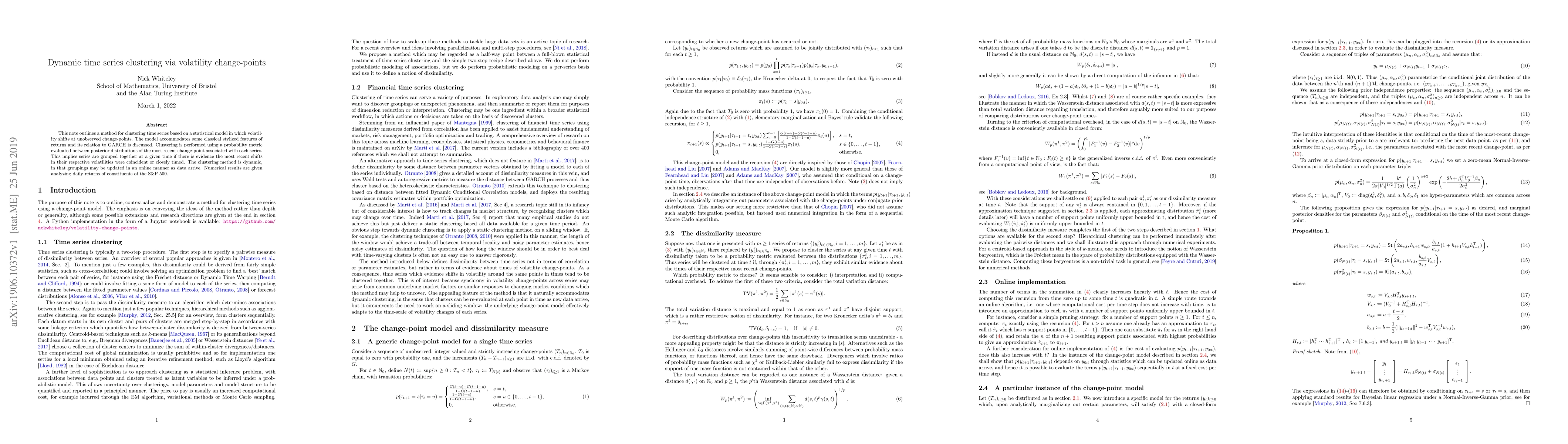

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStructural clustering of volatility regimes for dynamic trading strategies

Nick James, Max Menzies, Gilad Francis et al.

Network Modelling of Asynchronous Change-Points in Multivariate Time Series

Maria Kalli, Carson McKee

No citations found for this paper.

Comments (0)