Summary

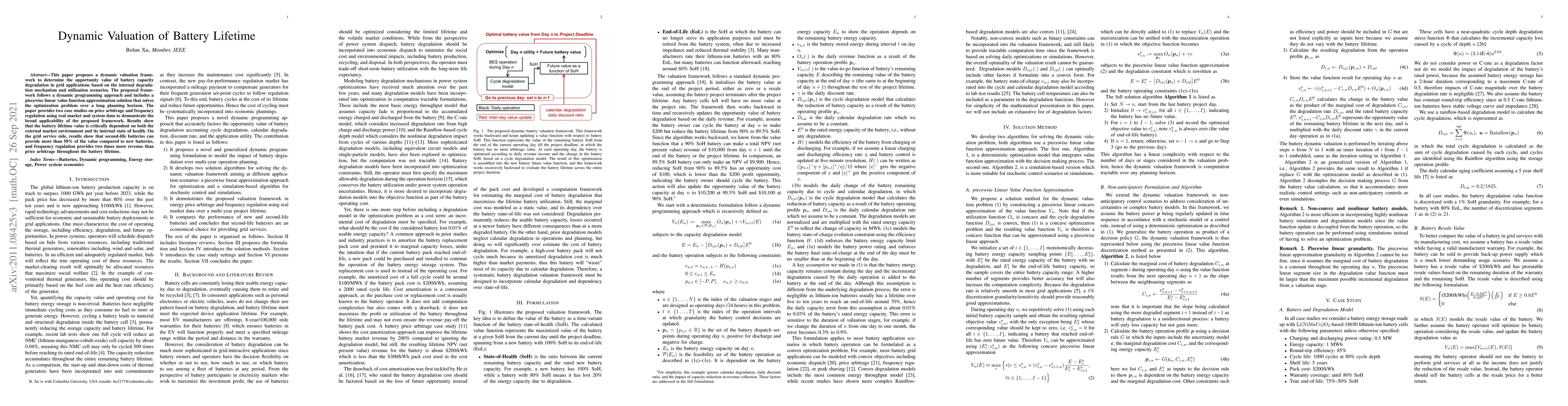

This paper proposes a dynamic valuation framework to determine the opportunity value of battery capacity degradation in grid applications based on the internal degradation mechanism and utilization scenarios. The proposed framework follows a dynamic programming approach and includes a piecewise linear value function approximation solution that solves the optimization problem over a long planning horizon. The paper provides two case studies on price arbitrage and frequency regulation using real market and system data to demonstrate the broad applicability of the proposed framework. Results show that the battery lifetime value is critically dependent on both the external market environment and its internal state of health. On the grid service side, results show that second-life batteries can provide more than 50% of the value compared to new batteries, and frequency regulation provides two times more revenue than price arbitrage throughout the battery lifetime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of potential lifetime extension through dynamic battery reconfiguration

Torsten Wik, Changfu Zou, Albert Skegro

Bayesian hierarchical modelling for battery lifetime early prediction

Zihao Zhou, David A. Howey

| Title | Authors | Year | Actions |

|---|

Comments (0)