Summary

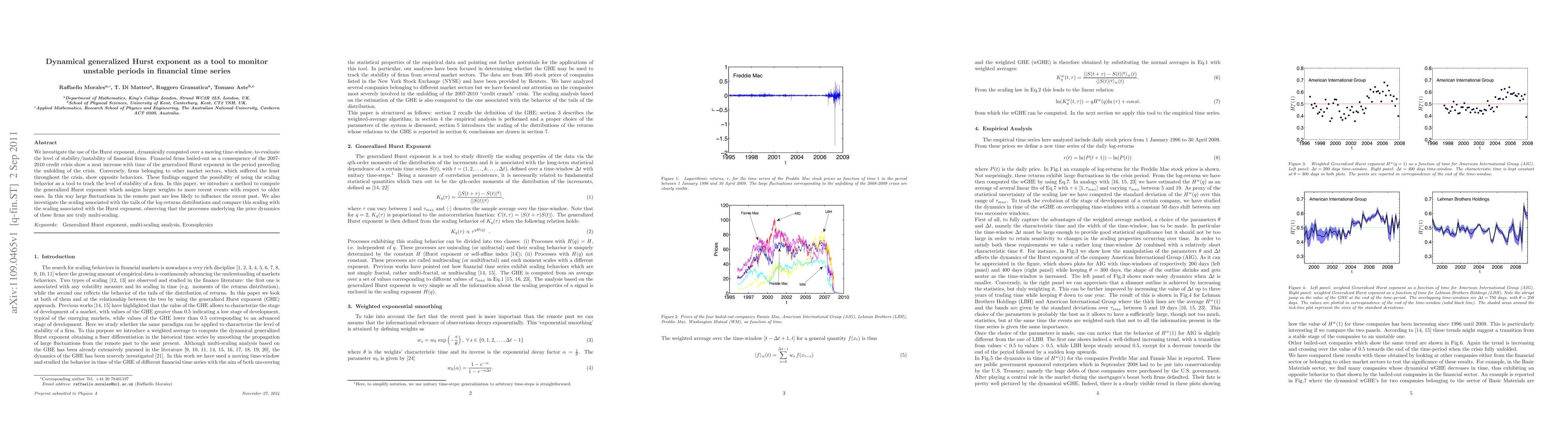

We investigate the use of the Hurst exponent, dynamically computed over a moving time-window, to evaluate the level of stability/instability of financial firms. Financial firms bailed-out as a consequence of the 2007-2010 credit crisis show a neat increase with time of the generalized Hurst exponent in the period preceding the unfolding of the crisis. Conversely, firms belonging to other market sectors, which suffered the least throughout the crisis, show opposite behaviors. These findings suggest the possibility of using the scaling behavior as a tool to track the level of stability of a firm. In this paper, we introduce a method to compute the generalized Hurst exponent which assigns larger weights to more recent events with respect to older ones. In this way large fluctuations in the remote past are less likely to influence the recent past. We also investigate the scaling associated with the tails of the log-returns distributions and compare this scaling with the scaling associated with the Hurst exponent, observing that the processes underlying the price dynamics of these firms are truly multi-scaling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)