Summary

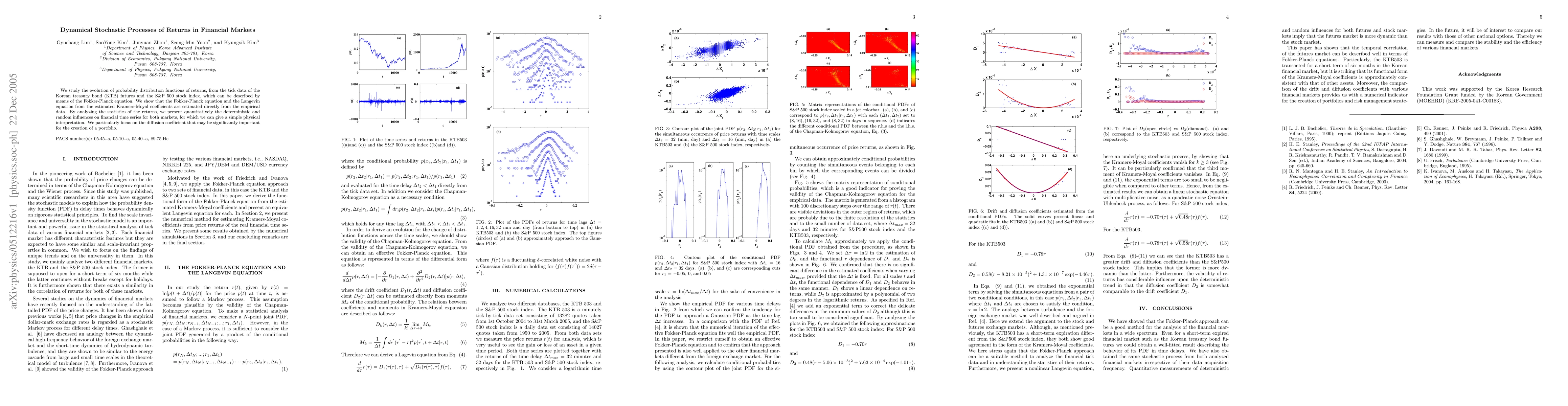

We study the evolution of probability distribution functions of returns, from the tick data of the Korean treasury bond (KTB) futures and the S$&$P 500 stock index, which can be described by means of the Fokker-Planck equation. We show that the Fokker-Planck equation and the Langevin equation from the estimated Kramers-Moyal coefficients are estimated directly from the empirical data. By analyzing the statistics of the returns, we present quantitatively the deterministic and random influences on financial time series for both markets, for which we can give a simple physical interpretation. We particularly focus on the diffusion coefficient that may be significantly important for the creation of a portfolio.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used empirical data from the Korean treasury bond (KTB) futures and the S$&$P 500 stock index to estimate the Fokker-Planck equation and the Langevin equation.

Key Results

- The probability distribution functions of returns can be described by the Fokker-Planck equation.

- The Langevin equation from the estimated Kramers-Moyal coefficients is also applicable.

- The diffusion coefficient significantly affects portfolio creation.

Significance

This research provides a simple physical interpretation of financial time series and highlights the importance of the diffusion coefficient in portfolio creation.

Technical Contribution

The research contributes to our understanding of dynamical stochastic processes in financial markets.

Novelty

This study provides a novel approach to analyzing financial returns using the Fokker-Planck equation and the Langevin equation.

Limitations

- The analysis only considers the empirical data from two markets.

- The study does not account for other factors that may influence financial returns.

Future Work

- Investigating the impact of additional factors on financial time series.

- Developing a more comprehensive model incorporating multiple markets and factors.

Comments (0)