Summary

A major goal in Algorithmic Game Theory is to justify equilibrium concepts from an algorithmic and complexity perspective. One appealing approach is to identify natural distributed algorithms that converge quickly to an equilibrium. This paper established new convergence results for two generalizations of Proportional Response in Fisher markets with buyers having CES utility functions. The starting points are respectively a new convex and a new convex-concave formulation of such markets. The two generalizations correspond to suitable mirror descent algorithms applied to these formulations. Several of our new results are a consequence of new notions of strong Bregman convexity and of strong Bregman convex-concave functions, and associated linear rates of convergence, which may be of independent interest. Among other results, we analyze a damped generalized Proportional Response and show a linear rate of convergence in a Fisher market with buyers whose utility functions cover the full spectrum of CES utilities aside the extremes of linear and Leontief utilities; when these utilities are included, we obtain an empirical O(1/T) rate of convergence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

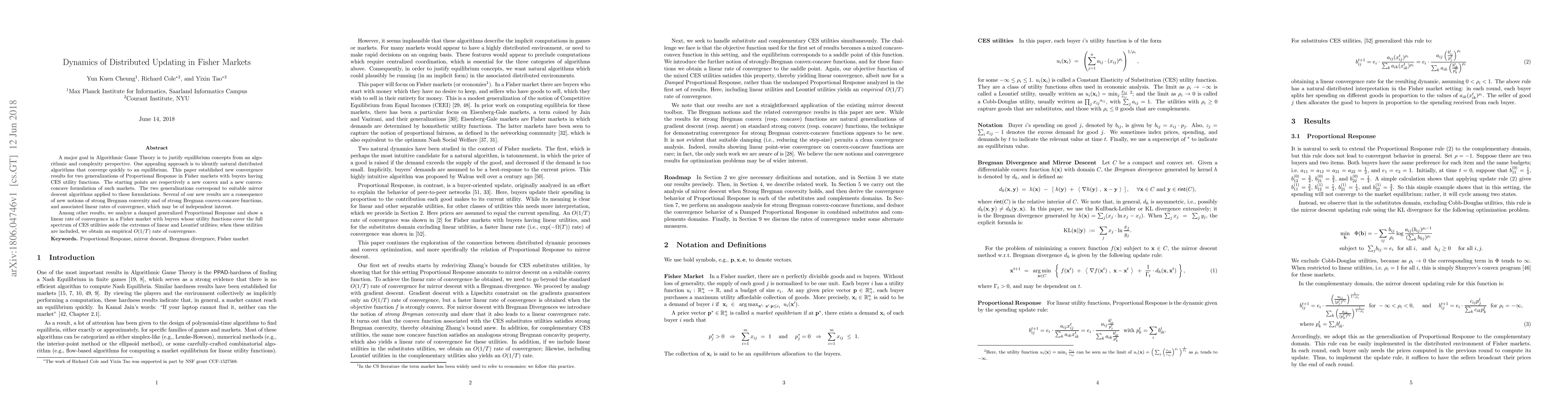

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersT\^atonnement in Homothetic Fisher Markets

Jiayi Zhao, Denizalp Goktas, Amy Greenwald

Fisher Markets with Social Influence

Jiayi Zhao, Denizalp Goktas, Amy Greenwald

Proportional Response Dynamics in Gross Substitutes Markets

Yun Kuen Cheung, Richard Cole, Yixin Tao

| Title | Authors | Year | Actions |

|---|

Comments (0)