Summary

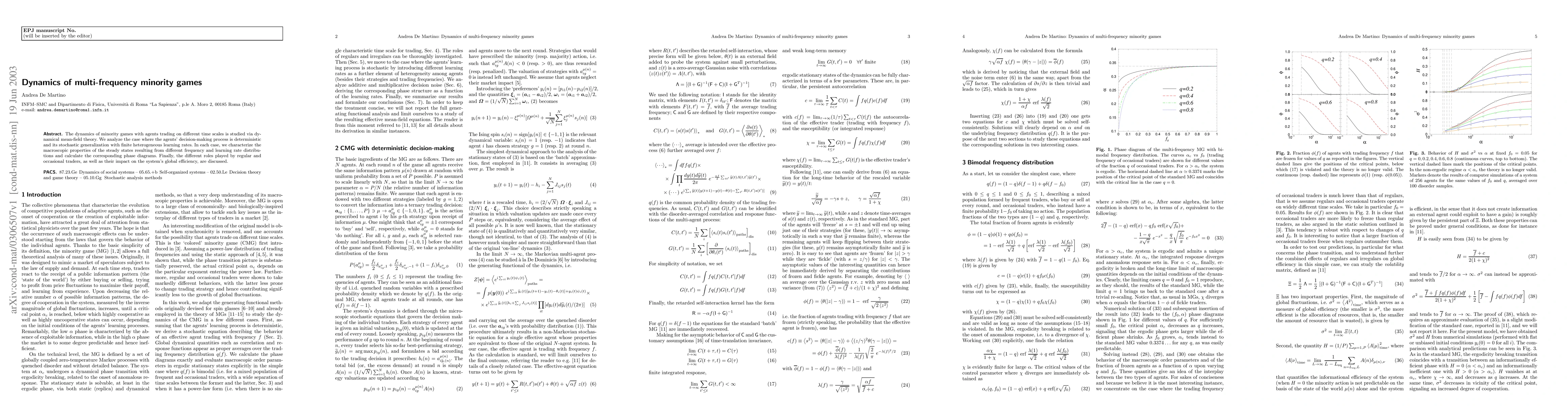

The dynamics of minority games with agents trading on different time scales is studied via dynamical mean-field theory. We analyze the case where the agents' decision-making process is deterministic and its stochastic generalization with finite heterogeneous learning rates. In each case, we characterize the macroscopic properties of the steady states resulting from different frequency and learning rate distributions and calculate the corresponding phase diagrams. Finally, the different roles played by regular and occasional traders, as well as their impact on the system's global efficiency, are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)