Summary

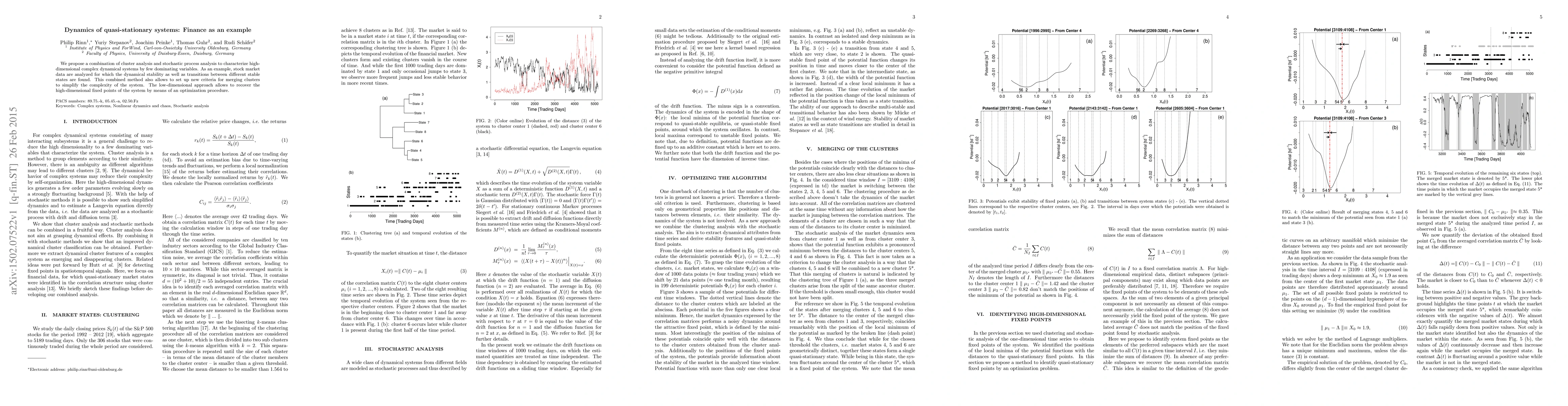

We propose a combination of cluster analysis and stochastic process analysis to characterize high-dimensional complex dynamical systems by few dominating variables. As an example, stock market data are analyzed for which the dynamical stability as well as transitions between different stable states are found. This combined method also allows to set up new criteria for merging clusters to simplify the complexity of the system. The low-dimensional approach allows to recover the high-dimensional fixed points of the system by means of an optimization procedure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransitions between quasi-stationary states in traffic systems: Cologne orbital motorways as an example

Shanshan Wang, Michael Schreckenberg, Thomas Guhr

| Title | Authors | Year | Actions |

|---|

Comments (0)