Summary

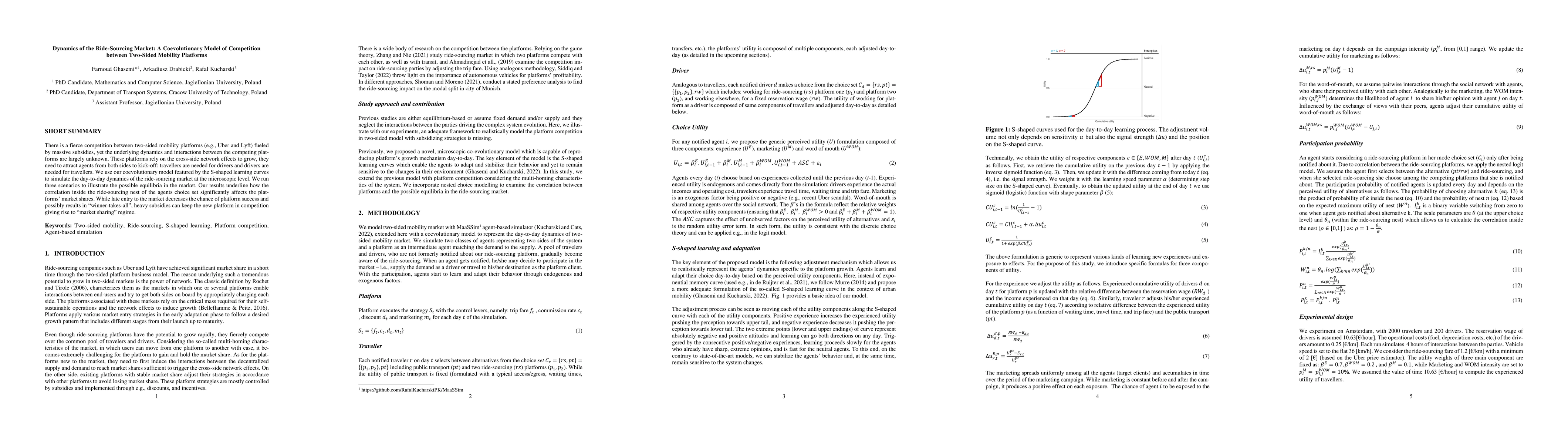

There is a fierce competition between two-sided mobility platforms (e.g., Uber and Lyft) fueled by massive subsidies, yet the underlying dynamics and interactions between the competing plat-forms are largely unknown. These platforms rely on the cross-side network effects to grow, they need to attract agents from both sides to kick-off: travellers are needed for drivers and drivers are needed for travellers. We use our coevolutionary model featured by the S-shaped learning curves to simulate the day-to-day dynamics of the ride-sourcing market at the microscopic level. We run three scenarios to illustrate the possible equilibria in the market. Our results underline how the correlation inside the ride-sourcing nest of the agents choice set significantly affects the plat-forms' market shares. While late entry to the market decreases the chance of platform success and possibly results in "winner-takes-all", heavy subsidies can keep the new platform in competition giving rise to "market sharing" regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA stochastic generalized Nash equilibrium model for platforms competition in the ride-hail market

Filippo Fabiani, Barbara Franci

Regulating Ride-Sourcing Markets: Can Minimum Wage Regulation Protect Drivers Without Disrupting the Market?

Farnoud Ghasemi, Rafal Kucharski, Oded Cats et al.

Pricing, competition and market segmentation in ride hailing

Veeraruna Kavitha, Jayakrishnan Nair, Tushar Shankar Walunj et al.

No citations found for this paper.

Comments (0)