Summary

A Dynkin game is considered for stochastic differential equations with random coefficients. We first apply Qiu and Tang's maximum principle for backward stochastic partial differential equations to generalize Krylov estimate for the distribution of a Markov process to that of a non-Markov process, and establish a generalized It\^o-Kunita-Wentzell's formula allowing the test function to be a random field of It\^o's type which takes values in a suitable Sobolev space. We then prove the verification theorem that the Nash equilibrium point and the value of the Dynkin game are characterized by the strong solution of the associated Hamilton-Jacobi-Bellman-Isaacs equation, which is currently a backward stochastic partial differential variational inequality (BSPDVI, for short) with two obstacles. We obtain the existence and uniqueness result and a comparison theorem for strong solution of the BSPDVI. Moreover, we study the monotonicity on the strong solution of the BSPDVI by the comparison theorem for BSPDVI and define the free boundaries. Finally, we identify the counterparts for an optimal stopping time problem as a special Dynkin game.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

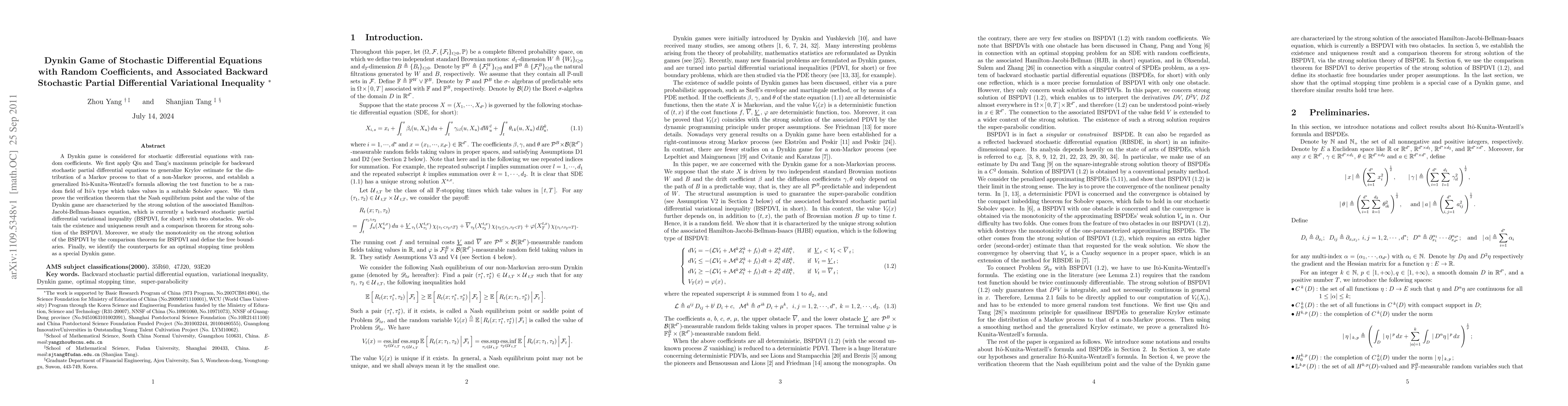

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)