Summary

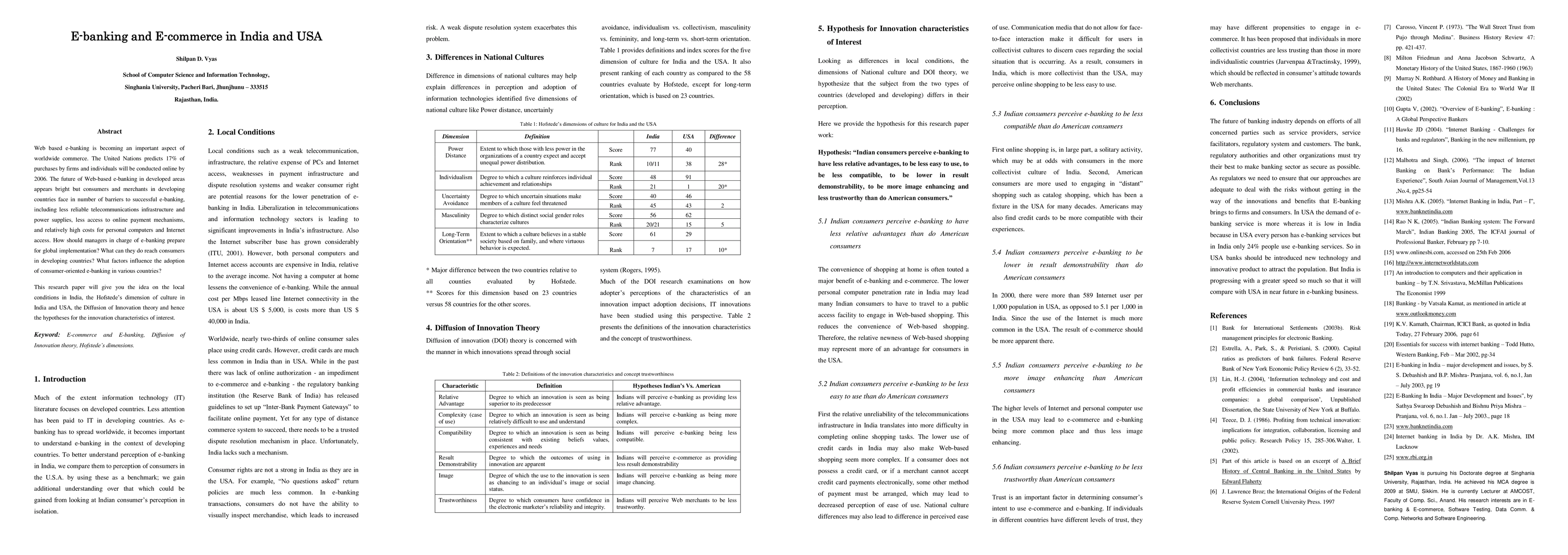

Web based e-banking is becoming an important aspect of worldwide commerce. The United Nations predicts 17% of purchases by firms and individuals will be conducted online by 2006. The future of Web-based e-banking in developed areas appears bright but consumers and merchants in developing countries face in number of barriers to successful e-banking, including less reliable telecommunications infrastructure and power supplies, less access to online payment mechanisms, and relatively high costs for personal computers and Internet access. How should managers in charge of e-banking prepare for global implementation? What can they do reach consumers in developing countries? What factors influence the adoption of consumer-oriented e-banking in various countries? This research paper will give you the idea on the local conditions in India, the Hofstede's dimension of culture in India and USA, the Diffusion of Innovation theory and hence the hypotheses for the innovation characteristics of interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInformation Discovery in e-Commerce

Zhaochun Ren, Maarten de Rijke, Xiangnan He et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)