Summary

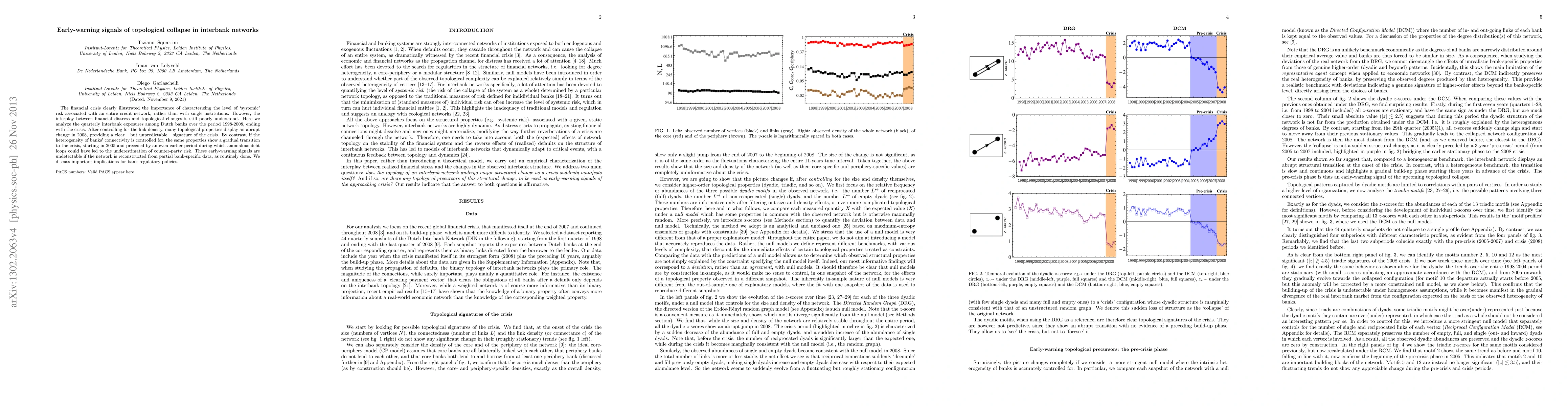

The financial crisis clearly illustrated the importance of characterizing the level of 'systemic' risk associated with an entire credit network, rather than with single institutions. However, the interplay between financial distress and topological changes is still poorly understood. Here we analyze the quarterly interbank exposures among Dutch banks over the period 1998-2008, ending with the crisis. After controlling for the link density, many topological properties display an abrupt change in 2008, providing a clear - but unpredictable - signature of the crisis. By contrast, if the heterogeneity of banks' connectivity is controlled for, the same properties show a gradual transition to the crisis, starting in 2005 and preceded by an even earlier period during which anomalous debt loops could have led to the underestimation of counter-party risk. These early-warning signals are undetectable if the network is reconstructed from partial bank-specific data, as routinely done. We discuss important implications for bank regulatory policies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)