Summary

In the financial sector, a reliable forecast the future financial performance of a company is of great importance for investors' investment decisions. In this paper we compare long-term short-term memory (LSTM) networks to temporal convolution network (TCNs) in the prediction of future earnings per share (EPS). The experimental analysis is based on quarterly financial reporting data and daily stock market returns. For a broad sample of US firms, we find that both LSTMs outperform the naive persistent model with up to 30.0% more accurate predictions, while TCNs achieve and an improvement of 30.8%. Both types of networks are at least as accurate as analysts and exceed them by up to 12.2% (LSTM) and 13.2% (TCN).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

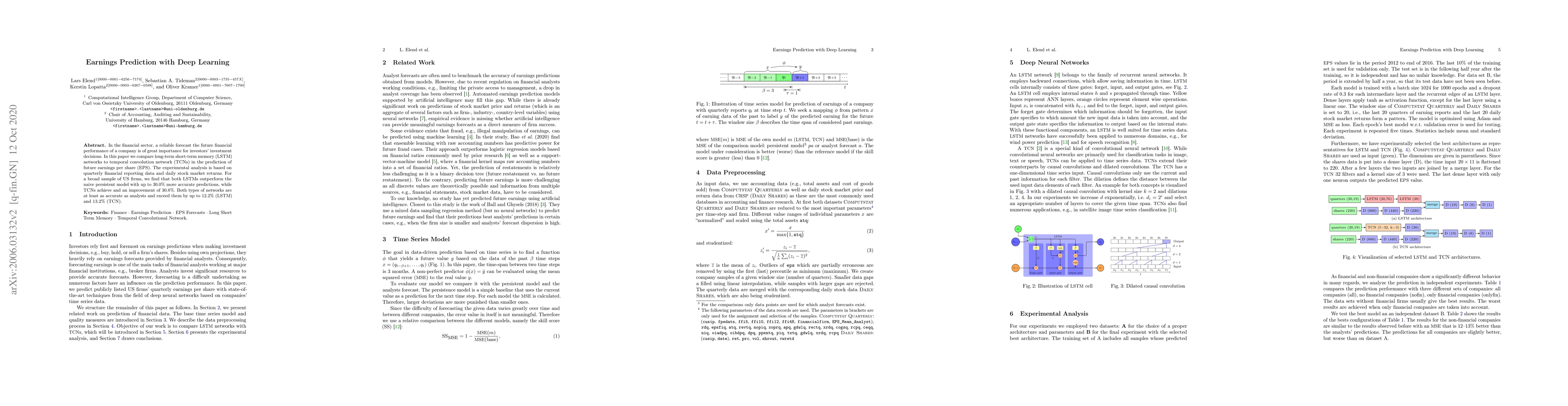

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEarnings Prediction Using Recurrent Neural Networks

Moritz Scherrmann, Ralf Elsas

Advanced Deep Learning Techniques for Analyzing Earnings Call Transcripts: Methodologies and Applications

Umair Zakir, Evan Daykin, Amssatou Diagne et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)