Summary

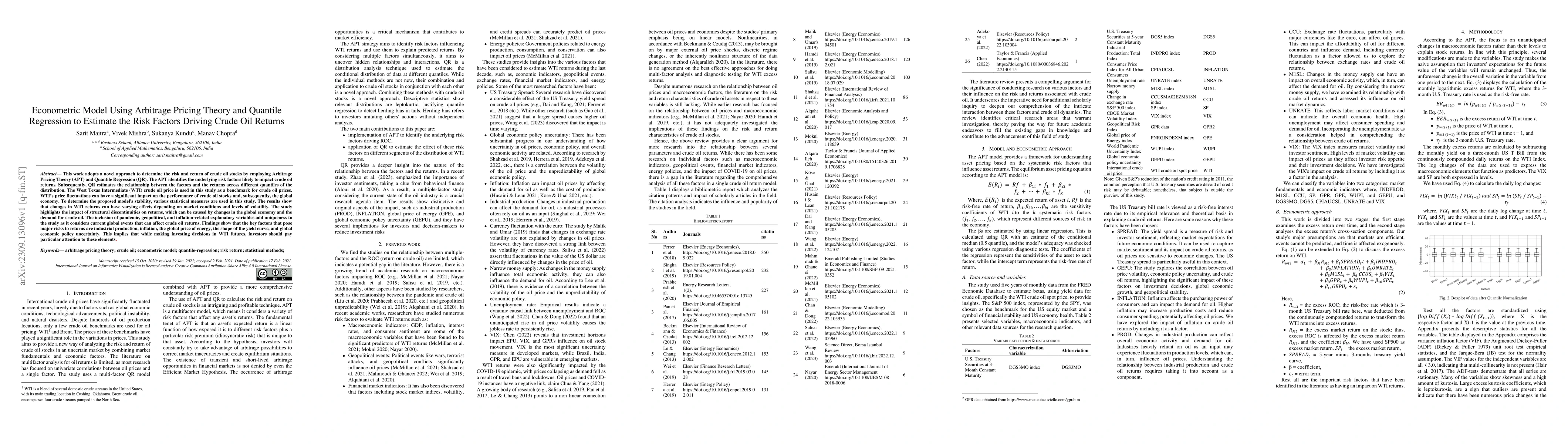

This work adopts a novel approach to determine the risk and return of crude oil stocks by employing Arbitrage Pricing Theory (APT) and Quantile Regression (QR).The APT identifies the underlying risk factors likely to impact crude oil returns.Subsequently, QR estimates the relationship between the factors and the returns across different quantiles of the distribution. The West Texas Intermediate (WTI) crude oil price is used in this study as a benchmark for crude oil prices. WTI price fluctuations can have a significant impact on the performance of crude oil stocks and, subsequently, the global economy.To determine the proposed models stability, various statistical measures are used in this study.The results show that changes in WTI returns can have varying effects depending on market conditions and levels of volatility. The study highlights the impact of structural discontinuities on returns, which can be caused by changes in the global economy and the demand for crude oil.The inclusion of pandemic, geopolitical, and inflation-related explanatory variables add uniqueness to this study as it considers current global events that can affect crude oil returns.Findings show that the key factors that pose major risks to returns are industrial production, inflation, the global price of energy, the shape of the yield curve, and global economic policy uncertainty.This implies that while making investing decisions in WTI futures, investors should pay particular attention to these elements

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA hidden Markov model for statistical arbitrage in international crude oil futures markets

Claudio Fontana, Viviana Fanelli, Francesco Rotondi

Regime Switching Entropic Risk Measures on Crude Oil Pricing

Robert J. Elliott, Babacar Seck

No citations found for this paper.

Comments (0)