Authors

Summary

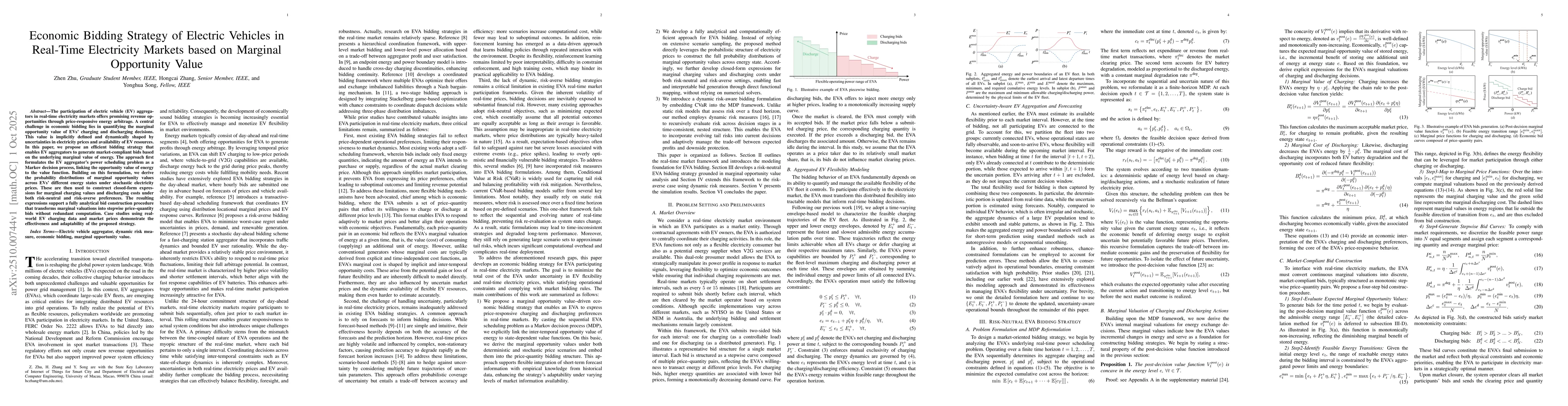

The participation of electric vehicle (EV) aggregators in real-time electricity markets offers promising revenue opportunities through price-responsive energy arbitrage. A central challenge in economic bidding lies in quantifying the marginal opportunity value of EVs' charging and discharging decisions. This value is implicitly defined and dynamically shaped by uncertainties in electricity prices and availability of EV resources. In this paper, we propose an efficient bidding strategy that enables EV aggregators to generate market-compliant bids based on the underlying marginal value of energy. The approach first formulates the EV aggregator's power scheduling problem as a Markov decision process, linking the opportunity value of energy to the value function. Building on this formulation, we derive the probability distributions of marginal opportunity values across EVs' different energy states under stochastic electricity prices. These are then used to construct closed-form expressions for marginal charging values and discharging costs under both risk-neutral and risk-averse preferences. The resulting expressions support a fully analytical bid construction procedure that transforms marginal valuations into stepwise price-quantity bids without redundant computation. Case studies using real-world EV charging data and market prices demonstrate the effectiveness and adaptability of the proposed strategy.

AI Key Findings

Generated Oct 04, 2025

Methodology

The research employs a combination of analytical modeling and simulation to develop a bidding strategy for electric vehicle aggregators (EVAs) in real-time electricity markets. It integrates historical electricity price distributions with marginal opportunity value calculations to construct price-responsive bids under both risk-neutral and risk-averse scenarios.

Key Results

- The proposed strategy achieves a 31.5% cost reduction compared to the uncoordinated benchmark, with further improvements reaching 35% under risk-averse settings.

- Short-term price forecasts significantly enhance bidding performance, with over 80% of potential cost savings realized even with a 30-minute forecast window.

- Risk-averse strategies demonstrate reduced battery degradation costs while maintaining operational efficiency, with the most conservative approaches achieving up to 10% cost increases but 20% lower degradation expenses.

Significance

This research provides a robust framework for EVAs to optimize participation in real-time electricity markets, enhancing economic performance and resilience to price volatility. The methodology could be applied to various energy resource aggregators, contributing to more efficient and reliable grid operations.

Technical Contribution

The paper introduces a closed-form analytical approach for constructing price-responsive bids, eliminating the need for scenario-based optimization. It also develops a hybrid training framework that combines historical price distributions with short-term forecasts to enhance bidding accuracy.

Novelty

This work uniquely combines risk-averse dynamic programming with real-time electricity price distributions to create a flexible bidding framework. The integration of both risk-neutral and risk-averse strategies within a single analytical framework is a novel contribution to energy market participation strategies.

Limitations

- The study assumes perfect information about price deviations within forecast windows, which may not reflect real-world conditions.

- The aggregated EVA model contains structural approximations that may affect the accuracy of bidding strategies.

Future Work

- Exploring the integration of real-time market sentiment analysis with bidding strategies.

- Investigating the impact of longer-term price forecasting on bidding performance.

- Developing adaptive risk measures that dynamically adjust based on market conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Real-time Bidding Strategy For EV Aggregators in Wholesale Electricity Markets

Yue Chen, Shihan Huang, Dongkun Han et al.

Aggregator of Electric Vehicles Bidding in Nordic FCR-D Markets: A Chance-Constrained Program

Jalal Kazempour, Gustav A. Lunde, Emil V. Damm et al.

Optimizing Bidding Curves for Renewable Energy in Two-Settlement Electricity Markets

Audun Botterud, Dongwei Zhao, Stefanos Delikaraogloub et al.

Comments (0)