Summary

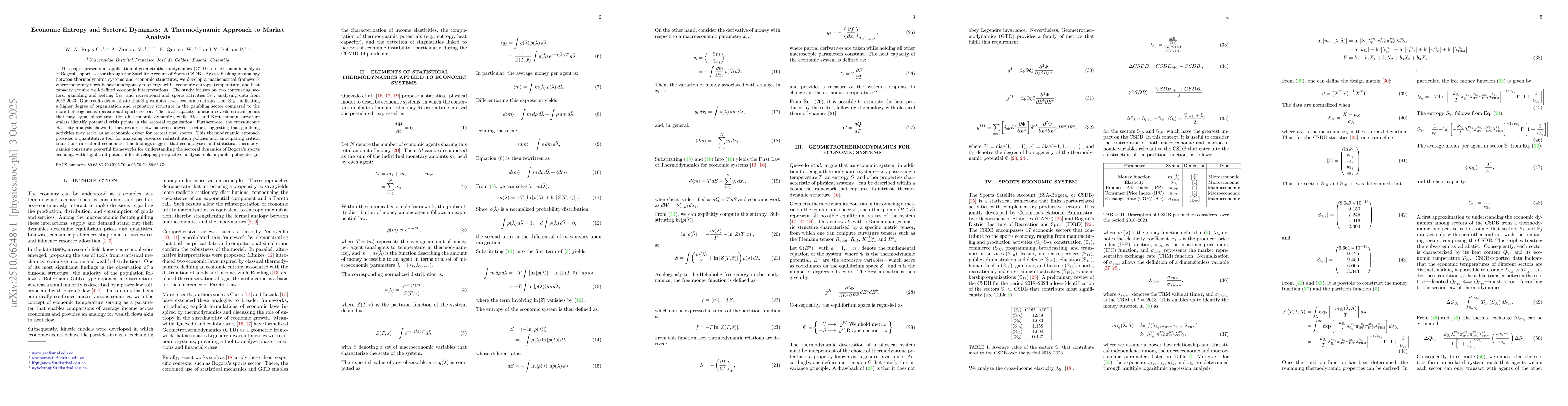

This paper presents an application of geometrothermodynamics (GTD) to the economic analysis of Bogot\'a's sports sector through the Satellite Account of Sport (CSDB). By establishing an analogy between thermodynamic systems and economic structures, we develop a mathematical framework where monetary flows behave analogously to energy, while economic entropy, temperature, and heat capacity acquire well-defined economic interpretations. The study focuses on two contrasting sectors: gambling and betting $\mathbb{S}_{15}$, and recreational and sports activities $\mathbb{S}_{16}$, analyzing data from 2018-2023. Our results demonstrate that $\mathbb{S}_{15}$ exhibits lower economic entropy than $\mathbb{S}_{16}$ , indicating a higher degree of organization and regulatory structure in the gambling sector compared to the more heterogeneous recreational sports sector. The heat capacity function reveals critical points that may signal phase transitions in economic dynamics, while Ricci and Kretschmann curvature scalars identify potential crisis points in the sectoral organization. Furthermore, the cross-income elasticity analysis shows distinct resource flow patterns between sectors, suggesting that gambling activities may serve as an economic driver for recreational sports. This thermodynamic approach provides a quantitative tool for analyzing resource redistribution policies and anticipating critical transitions in sectoral economics. The findings suggest that econophysics and statistical thermodynamics constitute powerful frameworks for understanding the sectoral dynamics of Bogot\'a's sports economy, with significant potential for developing prospective analysis tools in public policy design.

AI Key Findings

Generated Oct 12, 2025

Methodology

The study applies geometrothermodynamics (GTD) to economic analysis, establishing an analogy between thermodynamic systems and economic structures. It uses data from the Satellite Account of Sport (CSDB) for Bogotá's sports sectors (S15: gambling/betting, S16: recreational/sports) over 2018-2023, employing statistical thermodynamics and econophysics frameworks to model monetary flows as energy and derive economic entropy, temperature, and heat capacity.

Key Results

- Sector S15 (gambling/betting) exhibits lower economic entropy than S16 (recreational/sports), indicating higher organization and regulatory structure in S15.

- Heat capacity analysis shows S16 requires more activation energy, reflecting greater investment needs for infrastructure and specialized equipment compared to S15.

- Curvature scalars (Ricci and Kretschmann) reveal phase transition points and potential crisis indicators in sectoral organization, with divergences observed at specific temperatures.

Significance

This research provides a quantitative thermodynamic framework for analyzing economic sector dynamics, offering tools for policy design and crisis anticipation. It bridges econophysics and statistical thermodynamics to model economic systems as complex thermodynamic entities, enhancing understanding of resource redistribution and systemic stability.

Technical Contribution

Develops a partition function and thermodynamic potentials (entropy, heat capacity) for economic sectors, integrating geometrothermodynamics with econophysics to quantify resource flows and systemic stability through curvature diagnostics.

Novelty

Introduces a geometrothermodynamic framework for economic analysis, using curvature scalars as early-warning indicators for sectoral crises and linking economic entropy to regulatory efficiency and systemic coherence.

Limitations

- Data on market agents per sector is confidential, limiting detailed analysis of agent behavior.

- The study focuses only on two sectors (S15 and S16) of the CSDB, restricting broader applicability to other sectors.

Future Work

- Extend analysis to all 17 sectors of the CSDB to map realistic interaction networks.

- Incorporate longer and higher-frequency time series to validate model robustness.

- Benchmark against conventional macroeconomic indicators to assess predictive power during crises or expansions.

Paper Details

PDF Preview

Similar Papers

Found 5 papersExploring Economic Sectoral Dynamics Through High-resolution Mobility Data

Andreas Züfle, Hossein Amiri, Timothy F Leslie

Macroeconomic Dynamics in a finite world: the Thermodynamic Potential Approach

Christophe Goupil, Éric Herbert, and Gael Giraud et al.

Comments (0)