Authors

Summary

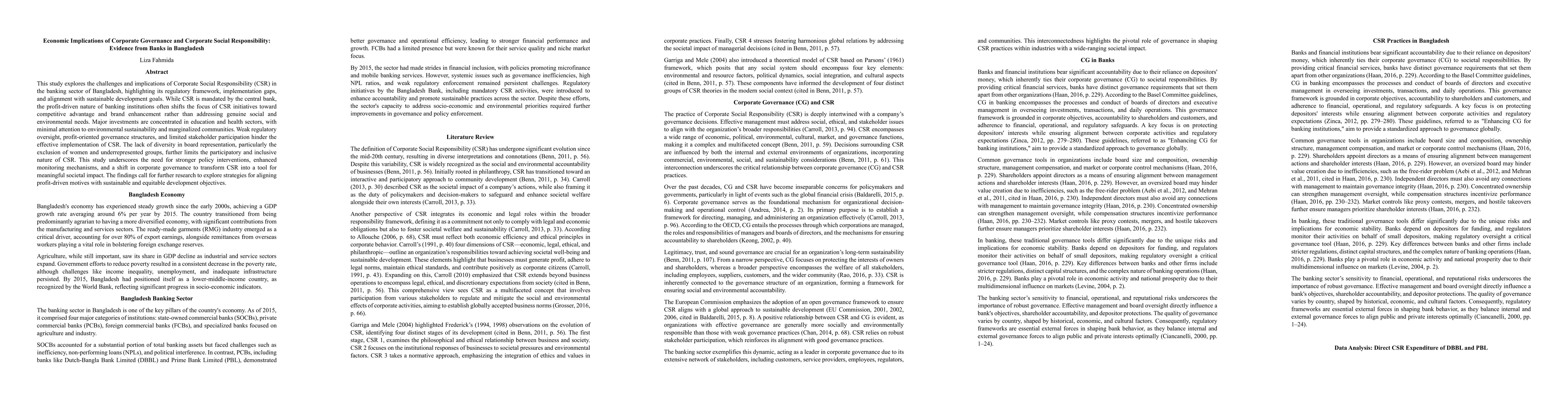

This study explores the challenges and implications of Corporate Social Responsibility (CSR) in the banking sector of Bangladesh, highlighting its regulatory framework, implementation gaps, and alignment with sustainable development goals. While the central bank mandates CSR, the profit-driven nature of banking institutions often shifts the focus of CSR initiatives toward competitive advantage and brand enhancement rather than addressing genuine social and environmental needs. Major investments are concentrated in the education and health sectors, with minimal attention to ecological sustainability and marginalized communities. Weak regulatory oversight, profit-oriented governance structures, and limited stakeholder participation hinder the effective implementation of CSR. The lack of diversity in board representation, particularly the exclusion of women and underrepresented groups, further limits CSR's participatory and inclusive nature. This study underscores the need for stronger policy interventions, enhanced monitoring mechanisms, and a shift in corporate governance to transform CSR into a tool for meaningful societal impact. The findings call for further research to explore strategies for aligning profit-driven motives with sustainable and equitable development objectives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCSRCZ: A Dataset About Corporate Social Responsibility in Czech Republic

Erion Çano, Xhesilda Vogli

Investigating Corporate Social Responsibility Initiatives: Examining the case of corporate Covid-19 response

Purvi Shah, Aniruddha Dutta, Meheli Basu

No citations found for this paper.

Comments (0)