Authors

Summary

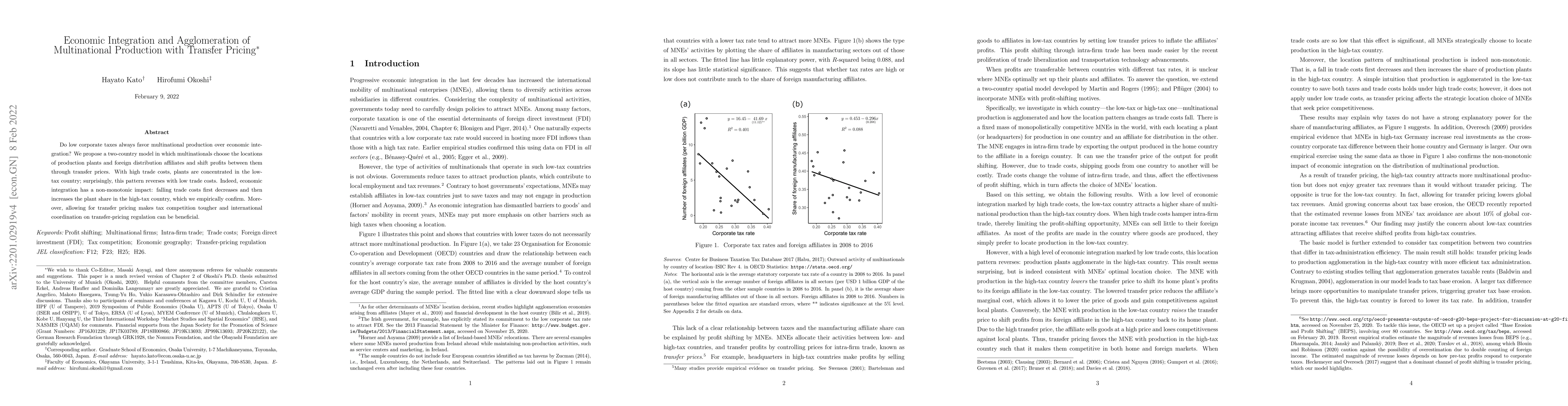

Do low corporate taxes always favor multinational production over economic integration? We propose a two-country model in which multinationals choose the locations of production plants and foreign distribution affiliates and shift profits between them through transfer prices. With high trade costs, plants are concentrated in the low-tax country; surprisingly, this pattern reverses with low trade costs. Indeed, economic integration has a non-monotonic impact: falling trade costs first decrease and then increase the plant share in the high-tax country, which we empirically confirm. Moreover, allowing for transfer pricing makes tax competition tougher and international coordination on transfer-pricing regulation can be beneficial.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWorld City Networks and Multinational Firms: An Analysis of Economic Ties Over a Decade

Faraz Zaidi, Celine Rozenblat, Mohammed Adil Saleem

| Title | Authors | Year | Actions |

|---|

Comments (0)