Summary

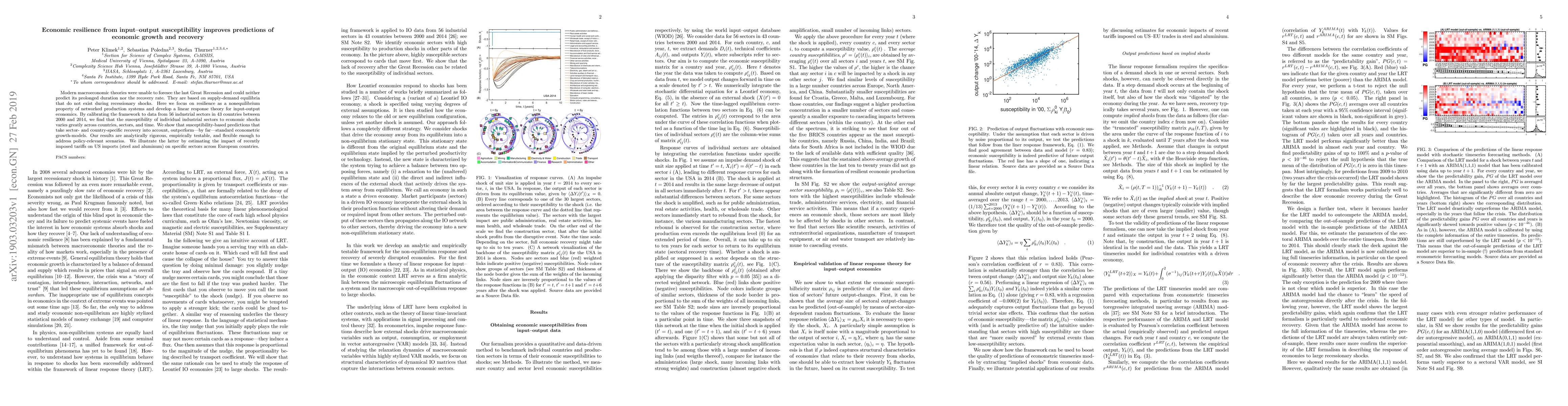

Modern macroeconomic theories were unable to foresee the last Great Recession and could neither predict its prolonged duration nor the recovery rate. They are based on supply-demand equilibria that do not exist during recessionary shocks. Here we focus on resilience as a nonequilibrium property of networked production systems and develop a linear response theory for input-output economics. By calibrating the framework to data from 56 industrial sectors in 43 countries between 2000 and 2014, we find that the susceptibility of individual industrial sectors to economic shocks varies greatly across countries, sectors, and time. We show that susceptibility-based predictions that take sector- and country-specific recovery into account, outperform--by far--standard econometric growth-models. Our results are analytically rigorous, empirically testable, and flexible enough to address policy-relevant scenarios. We illustrate the latter by estimating the impact of recently imposed tariffs on US imports (steel and aluminum) on specific sectors across European countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe networked input-output economic problem

Minh Hoang Trinh, Nhat-Minh Le-Phan, Hyo-Sung Ahn

The economic value of transport infrastructure in the UK: an input output analysis

Nikolaos Kalyviotis, Christopher D. F. Rogers, Geoffrey J. D. Hewings

An Agent-Based Extension to Sector-Wise Input-Output Recovery Models

Peter Klimek, Stefan Thurner, Jan Hurt

| Title | Authors | Year | Actions |

|---|

Comments (0)