Summary

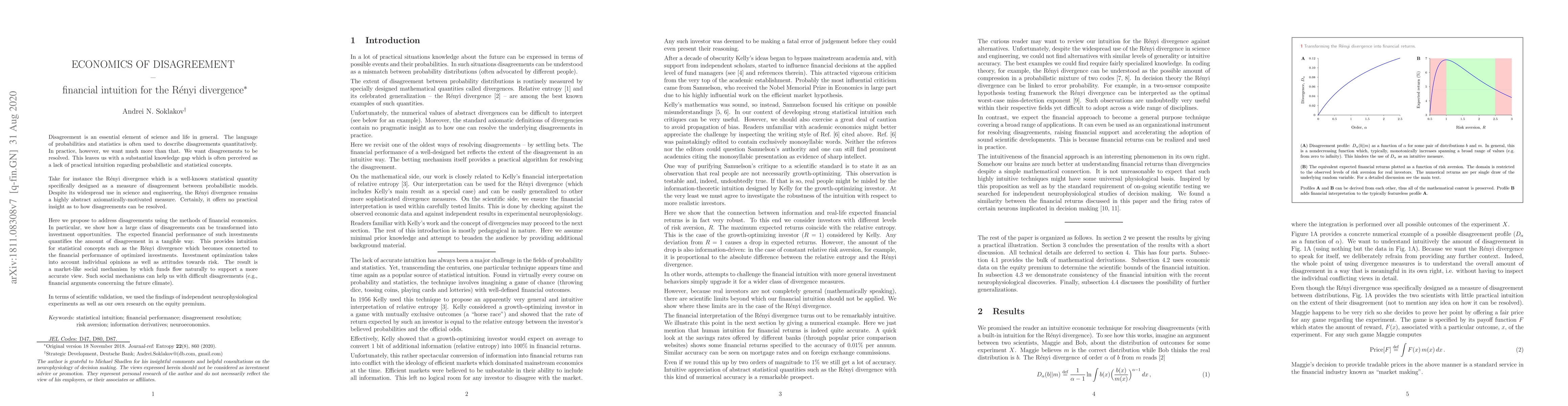

Disagreement is an essential element of science and life in general. The language of probabilities and statistics is often used to describe disagreements quantitatively. In practice, however, we want much more than that. We want disagreements to be resolved. This leaves us with a substantial knowledge gap which is often perceived as a lack of practical intuition regarding probabilistic and statistical concepts. Take for instance the R\'enyi divergence which is a well-known statistical quantity specifically designed as a measure of disagreement between probabilistic models. Despite its widespread use in science and engineering, the R\'enyi divergence remains a highly abstract axiomatically-motivated measure. Certainly, it offers no practical insight as to how disagreements can be resolved. Here we propose to address disagreements using the methods of financial economics. In particular, we show how a large class of disagreements can be transformed into investment opportunities. The expected financial performance of such investments quantifies the amount of disagreement in a tangible way. This provides intuition for statistical concepts such as the R\'enyi divergence which becomes connected to the financial performance of optimized investments. Investment optimization takes into account individual opinions as well as attitudes towards risk. The result is a market-like social mechanism by which funds flow naturally to support a more accurate view. Such social mechanisms can help us with difficult disagreements (e.g., financial arguments concerning the future climate). In terms of scientific validation, we used the findings of independent neurophysiological experiments as well as our own research on the equity premium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)