Summary

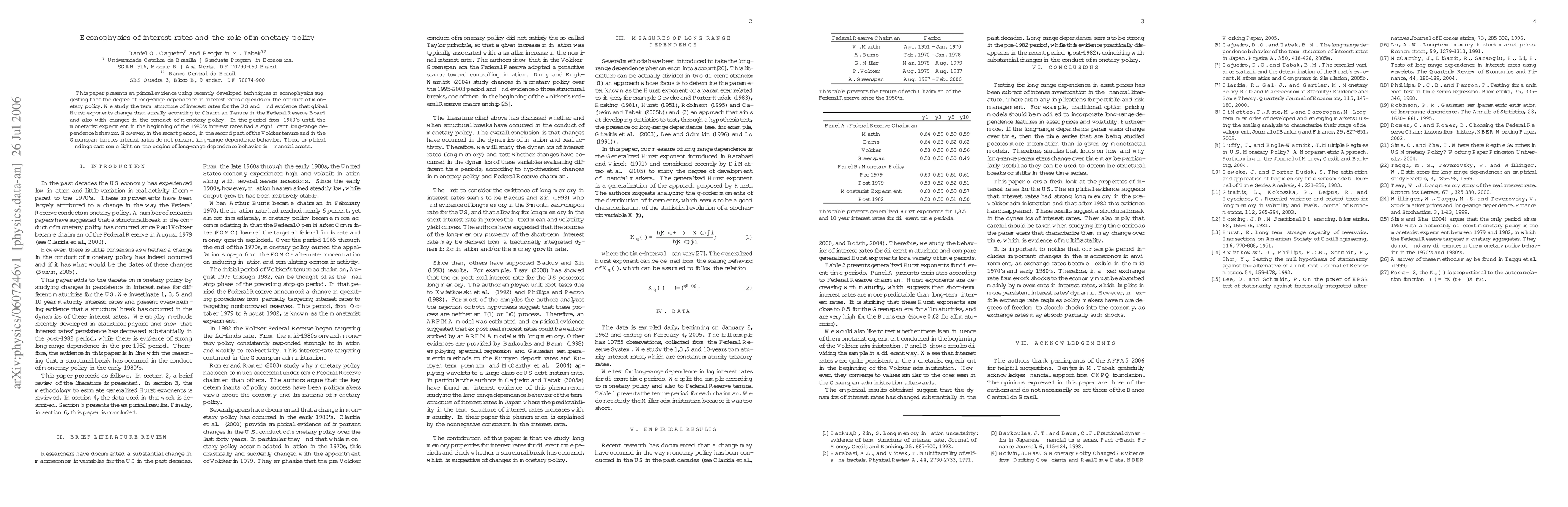

This paper presents empirical evidence using recently developed techniques in econophysics suggesting that the degree of long-range dependence in interest rates depends on the conduct of monetary policy. We study the term structure of interest rates for the US and find evidence that global Hurst exponents change dramatically according to Chairman Tenure in the Federal Reserve Board and also with changes in the conduct of monetary policy. In the period from 1960's until the monetarist experiment in the beginning of the 1980's interest rates had a significant long-range dependence behavior. However, in the recent period, in the second part of the Volcker tenure and in the Greenspan tenure, interest rates do not present long-range dependence behavior. These empirical findings cast some light on the origins of long-range dependence behavior in financial assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)