Summary

The economical world consists of a highly interconnected and interdependent network of firms. Here we develop temporal and structural network tools to analyze the state of the economy. Our analysis indicates that a strong clustering can be a warning sign. Reduction in diversity, which was an essential aspect of the dynamics surrounding the crash in 2008, is seen as a key emergent feature arising naturally from the evolutionary and adaptive dynamics inherent to the financial markets. Similarly, collusion amongst construction firms in a number of regions in Japan in the 2000s can be identified with the formation of clusters of anomalous highly connected companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

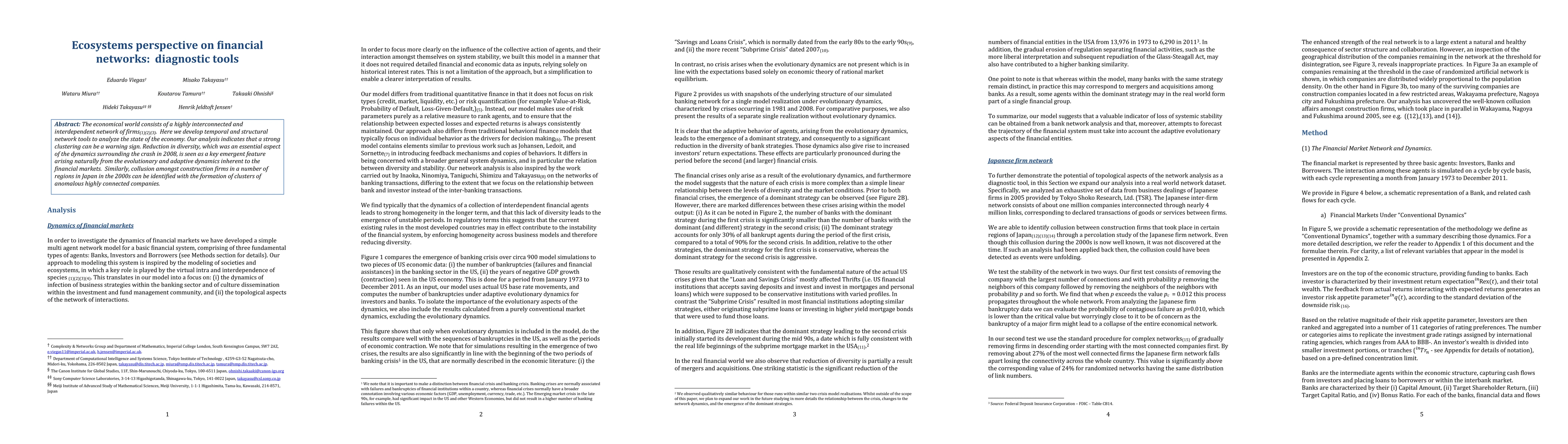

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)