Authors

Summary

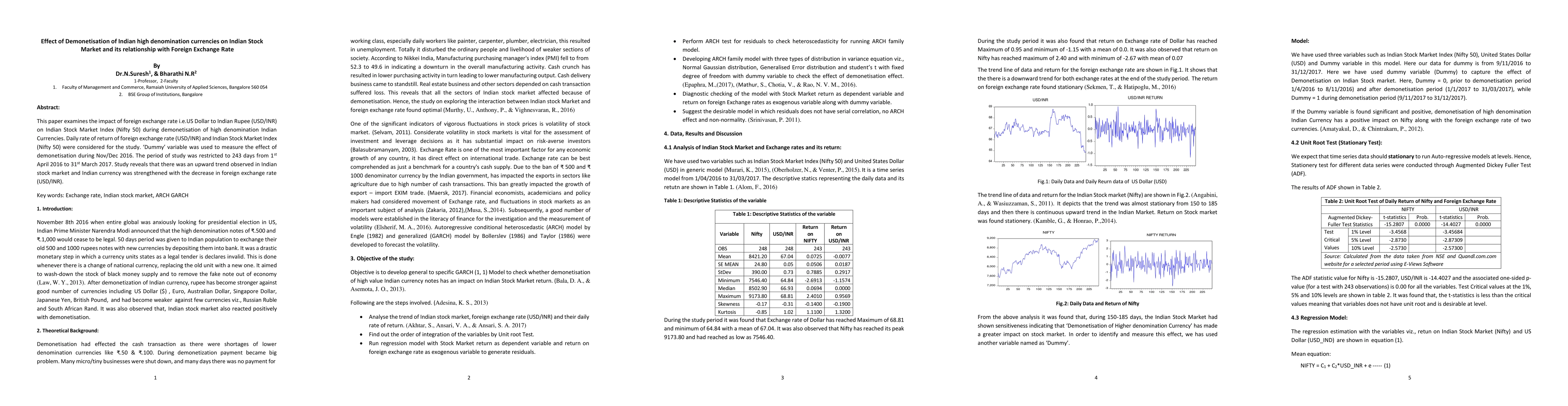

This study examines the impact of the foreign exchange rate, i.e., US Dollar to Indian Rupee (USD/INR) on the Indian Stock Market Index (Nifty 50) during the demonetization of high denomination Indian currencies. A daily rate of return of Foreign exchange rate (USD/INR) and the Indian Stock Market Index (Nifty 50) were considered for the study. The Dummy variable was used to measure the effect of demonetization during Nov/Dec 2016. The period of study was restricted to 243 days from 1st April 2016 to 31st March 2017. The study reveals that there was an upward trend observed in the Indian Stock Market and the Indian currency was strengthened with the decrease in the Foreign exchange rate (USD/INR).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)