Summary

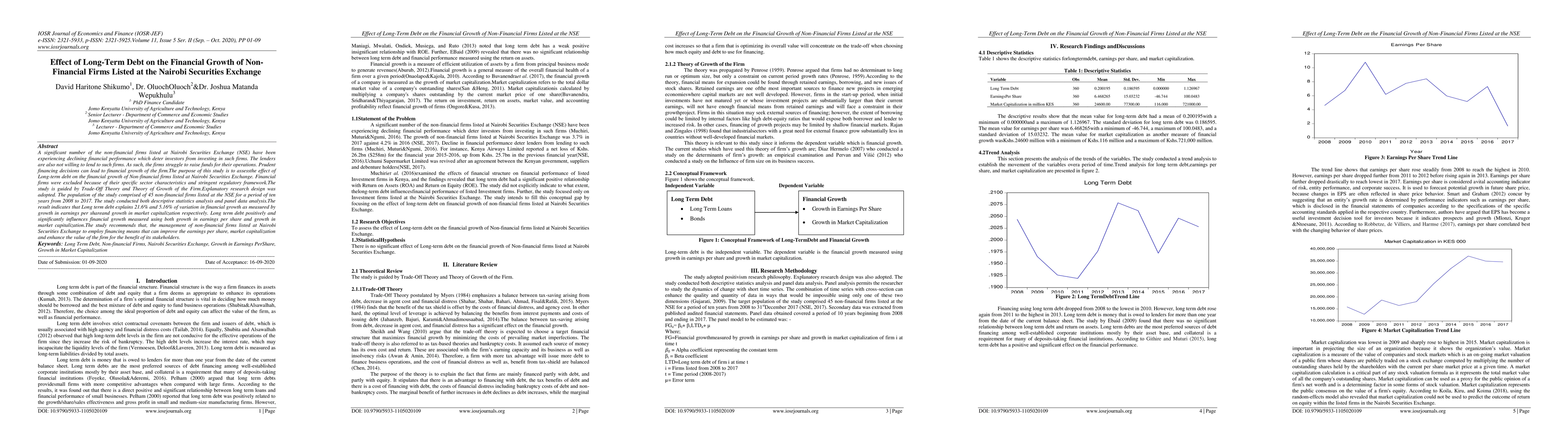

A significant number of the non-financial firms listed at Nairobi Securities Exchange (NSE) have been experiencing declining financial performance which deter investors from investing in such firms. The lenders are also not willing to lend to such firms. As such, the firms struggle to raise funds for their operations. Prudent financing decisions can lead to financial growth of the firm. The purpose of this study is to assess the effect of Long-term debt on the financial growth of Non-financial firms listed at Nairobi Securities Exchange. Financial firms were excluded because of their specific sector characteristics and stringent regulatory framework. The study is guided by Trade-Off Theory and Theory of Growth of the Firm. Explanatory research design was adopted. The population of the study comprised of 45 non-financial firms listed at the NSE for a period of ten years from 2008 to 2017. The study conducted both descriptive statistics analysis and panel data analysis. The result indicates that Long term debt explains 21.6% and 5.16% of variation in financial growth as measured by growth in earnings per share and growth in market capitalization respectively. Long term debt positively and significantly influences financial growth measured using both growth in earnings per share and growth in market capitalization. The study recommends that, the management of non-financial firms listed at Nairobi Securities Exchange to employ financing means that can improve the earnings per share, market capitalization and enhance the value of the firm for the benefit of its stakeholders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Structure, Firm Size and Financial Growth of Non-Financial Firms Listed at the Nairobi Securities Exchange

David Haritone Shikumo, Oluoch Oluoch, Joshua Matanda Wepukhulu

| Title | Authors | Year | Actions |

|---|

Comments (0)