Summary

In this manuscript we present a comprehensive study on the multifractal properties of high-frequency price fluctuations and instantaneous volatility of the equities that compose Dow Jones Industrial Average. The analysis consists about quantification of dependence and non-Gaussianity on the multifractal character of financial quantities. Our results point out an equivalent influence of dependence and non-Gaussianity on the multifractality of time series. Moreover, we analyse l-diagrams of price fluctuations. In the latter case, we show that the fractal dimension of these maps is basically independent of the lag between price fluctuations that we assume.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

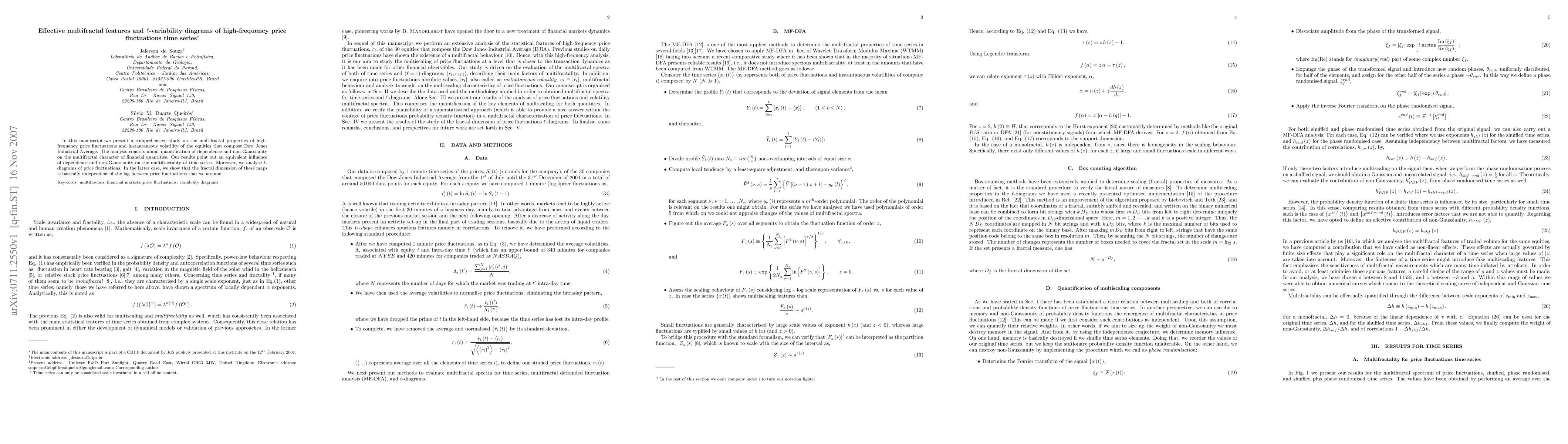

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)