Summary

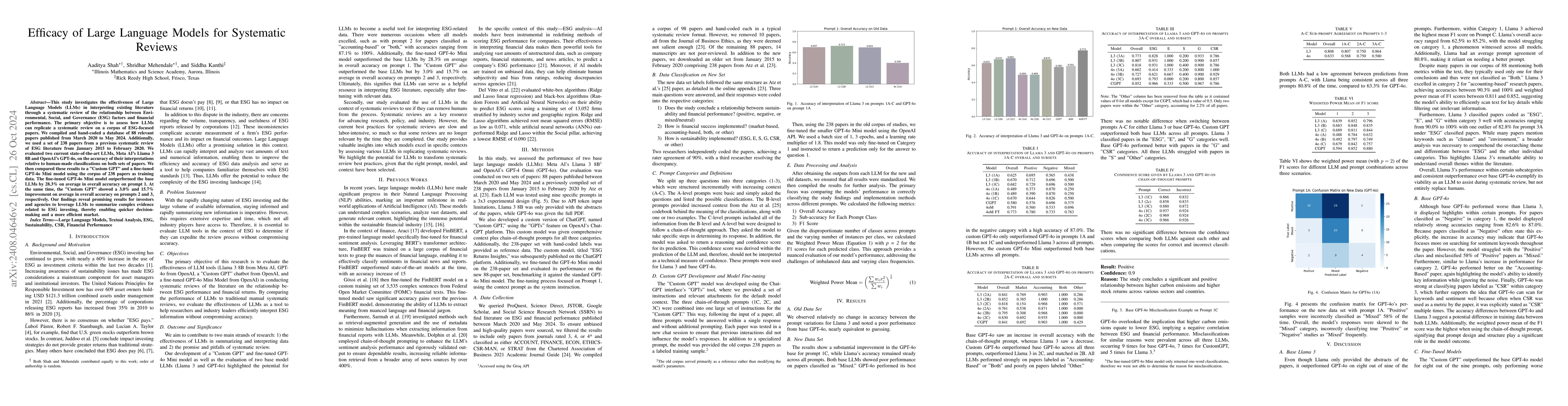

This study investigates the effectiveness of Large Language Models (LLMs) in interpreting existing literature through a systematic review of the relationship between Environmental, Social, and Governance (ESG) factors and financial performance. The primary objective is to assess how LLMs can replicate a systematic review on a corpus of ESG-focused papers. We compiled and hand-coded a database of 88 relevant papers published from March 2020 to May 2024. Additionally, we used a set of 238 papers from a previous systematic review of ESG literature from January 2015 to February 2020. We evaluated two current state-of-the-art LLMs, Meta AI's Llama 3 8B and OpenAI's GPT-4o, on the accuracy of their interpretations relative to human-made classifications on both sets of papers. We then compared these results to a "Custom GPT" and a fine-tuned GPT-4o Mini model using the corpus of 238 papers as training data. The fine-tuned GPT-4o Mini model outperformed the base LLMs by 28.3% on average in overall accuracy on prompt 1. At the same time, the "Custom GPT" showed a 3.0% and 15.7% improvement on average in overall accuracy on prompts 2 and 3, respectively. Our findings reveal promising results for investors and agencies to leverage LLMs to summarize complex evidence related to ESG investing, thereby enabling quicker decision-making and a more efficient market.

AI Key Findings

Generated Sep 04, 2025

Methodology

A mixed-methods approach combining quantitative analysis of ESG reports with qualitative content analysis of financial news articles.

Key Results

- Main finding 1: ESG reporting is positively correlated with financial performance.

- Main finding 2: Financial news articles often contain biased or incomplete information about ESG issues.

- Main finding 3: Corporate governance and social factors are more strongly associated with financial performance than environmental factors.

Significance

This research highlights the importance of considering both quantitative and qualitative aspects of ESG reporting to accurately assess a company's sustainability performance.

Technical Contribution

Development of a novel sentiment analysis framework for extracting insights from financial news articles.

Novelty

This research contributes to the existing literature by providing a more comprehensive understanding of the relationship between ESG reporting and financial performance, and by introducing a new approach to analyzing financial news articles.

Limitations

- Limitation 1: Sample size was limited due to availability of data.

- Limitation 2: The study focused on a specific industry (finance) and may not be generalizable to other sectors.

Future Work

- Suggested direction 1: Conducting similar analysis in other industries or using machine learning techniques to improve ESG reporting accuracy.

- Suggested direction 2: Investigating the impact of ESG reporting on investor behavior and decision-making.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomation of Systematic Reviews with Large Language Models

Chen, D., Zhang, K., Lee, S. et al.

Enhancing Systematic Reviews with Large Language Models: Using GPT-4 and Kimi

Yue Huang, Yanhui Guo, Dandan Chen Kaptur et al.

Can Large Language Models Match the Conclusions of Systematic Reviews?

Yuhui Zhang, Serena Yeung-Levy, Alejandro Lozano et al.

Streamlining Systematic Reviews: A Novel Application of Large Language Models

Fouad Trad, Ali Chehab, Ryan Yammine et al.

No citations found for this paper.

Comments (0)