Summary

In this paper the problem of optimal derivative design, profit maximization and risk minimization under adverse selection when multiple agencies compete for the business of a continuum of heterogenous agents is studied. The presence of ties in the agents' best-response correspondences yields discontinuous payoff functions for the agencies. These discontinuities are dealt with via efficient tie--breaking rules. In a first step, the model presented by Carlier, Ekeland & Touzi (2007) of optimal derivative design by profit-maximizing agencies is extended to a multiple--firm setting, and results of Page & Monteiro (2003, 2007, 2008) are used to prove the existence of (mixed-strategies) Nash equilibria. On a second step we consider the more complex case of risk minimizing firms. Here the concept of socially efficient allocations is introduced, and existence of the latter is proved. It is also shown that in the particular case of the entropic risk measure, there exists an efficient "fix--mix" tie-breaking rule, in which case firms share the whole market over given proportions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

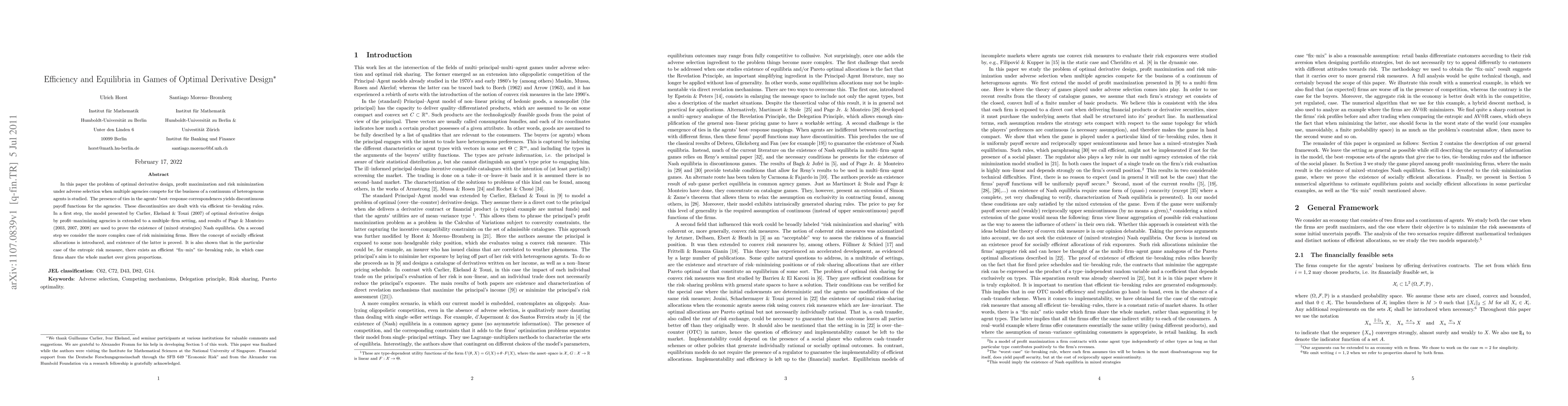

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)