Summary

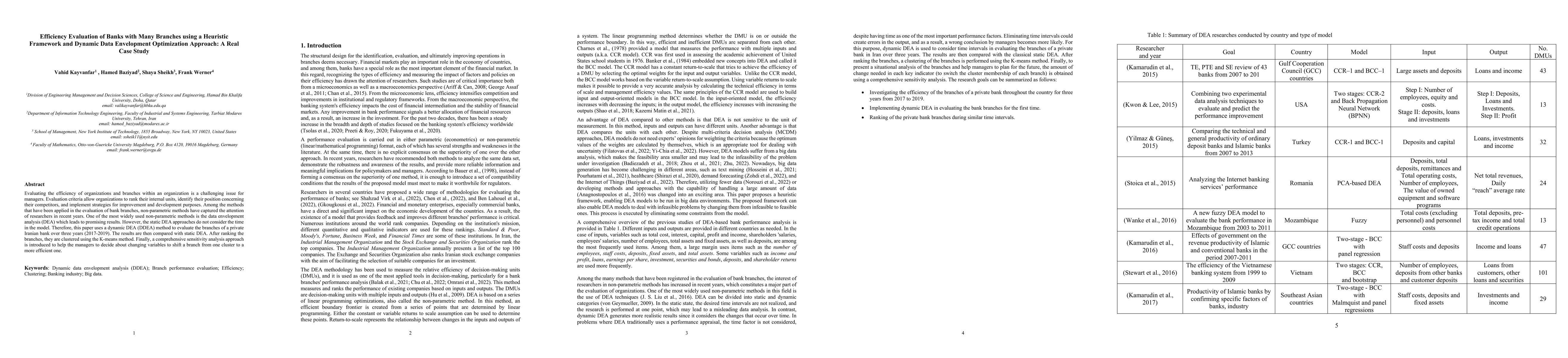

Evaluating the efficiency of organizations and branches within an organization is a challenging issue for managers. Evaluation criteria allow organizations to rank their internal units, identify their position concerning their competitors, and implement strategies for improvement and development purposes. Among the methods that have been applied in the evaluation of bank branches, non-parametric methods have captured the attention of researchers in recent years. One of the most widely used non-parametric methods is the data envelopment analysis (DEA) which leads to promising results. However, the static DEA approaches do not consider the time in the model. Therefore, this paper uses a dynamic DEA (DDEA) method to evaluate the branches of a private Iranian bank over three years (2017-2019). The results are then compared with static DEA. After ranking the branches, they are clustered using the K-means method. Finally, a comprehensive sensitivity analysis approach is introduced to help the managers to decide about changing variables to shift a branch from one cluster to a more efficient one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerformance evaluation of DMUs using hybrid fuzzy multi-objective data envelopment analysis

Awadh Pratap Singh, Shiv Prasad Yadav

Optimising 4th-Order Runge-Kutta Methods: A Dynamic Heuristic Approach for Efficiency and Low Storage

Gavin Lee Goodship, Luis Miralles-Pechuan, Stephen O'Sullivan

No citations found for this paper.

Comments (0)