Summary

In this paper an improved Cuckoo Search Algorithm is developed to allow for an efficient and robust calibration of the Heston option pricing model for American options. Calibration of stochastic volatility models like the Heston is significantly harder than classical option pricing models as more parameters have to be estimated. The difficult task of calibrating one of these models to American Put options data is the main objective of this paper. Numerical results are shown to substantiate the suitability of the chosen method to tackle this problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

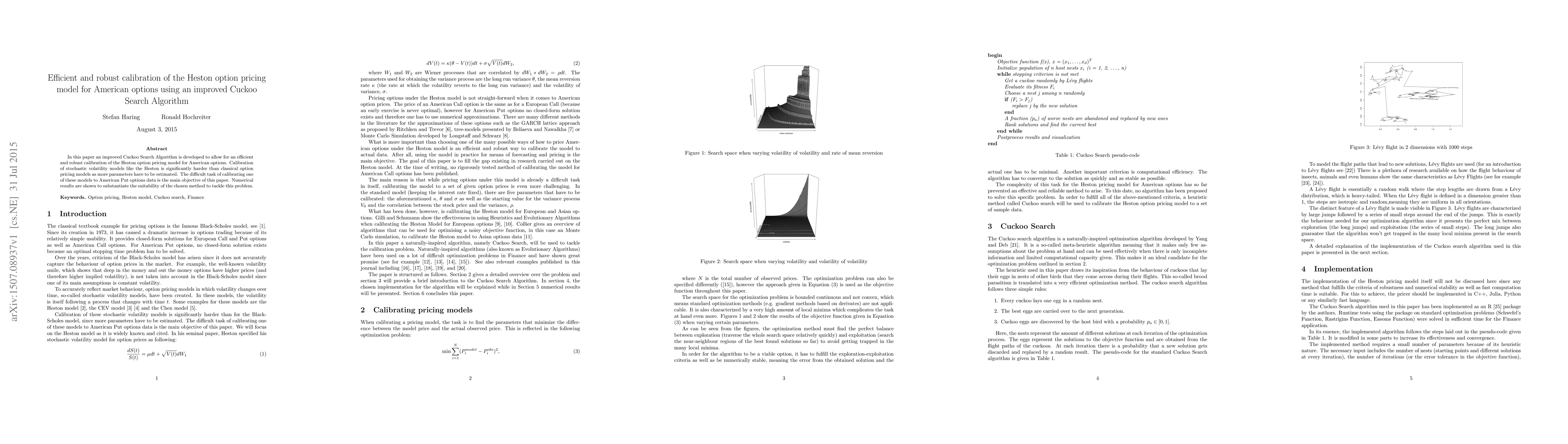

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAmerican options in the Volterra Heston model

Sergio Pulido, Etienne Chevalier, Elizabeth Zúñiga

| Title | Authors | Year | Actions |

|---|

Comments (0)