Summary

We discuss efficient Bayesian estimation of dynamic covariance matrices in multivariate time series through a factor stochastic volatility model. In particular, we propose two interweaving strategies (Yu and Meng, Journal of Computational and Graphical Statistics, 20(3), 531-570, 2011) to substantially accelerate convergence and mixing of standard MCMC approaches. Similar to marginal data augmentation techniques, the proposed acceleration procedures exploit non-identifiability issues which frequently arise in factor models. Our new interweaving strategies are easy to implement and come at almost no extra computational cost; nevertheless, they can boost estimation efficiency by several orders of magnitude as is shown in extensive simulation studies. To conclude, the application of our algorithm to a 26-dimensional exchange rate data set illustrates the superior performance of the new approach for real-world data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

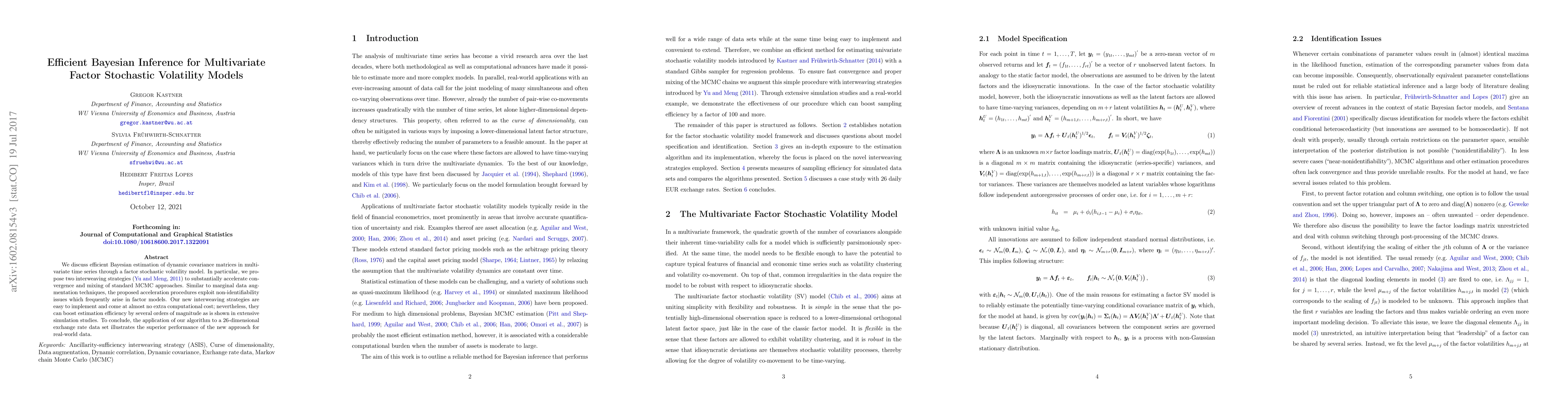

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFactor multivariate stochastic volatility models of high dimension

Benjamin Poignard, Manabu Asai

| Title | Authors | Year | Actions |

|---|

Comments (0)